Ozempic, a medication widely recognized for its efficacy in treating Type 2 diabetes, has emerged as a significant player in diabetes management. Its active ingredient, Semaglutide, effectively regulates blood sugar levels, aiding in better diabetes control. Besides its primary role in diabetes treatment, Ozempic also offers benefits in weight management, making it a dual-purpose medication for many patients. Tons of people in New York, California and Illinois want to know, “Is Ozempic Covered By United Healthcare?” We will dive into UHC coverage of Ozempic in this article.

United Healthcare Coverage for Ozempic: What You Need to Know

Navigating health insurance coverage can often be complex, especially when it comes to specific medications like Ozempic. United Healthcare, as one of the largest health insurance providers in the United States, offers various plans, each with its nuances in coverage. Understanding these details is crucial for patients who rely on Ozempic for their diabetes management.

Call the United Healthcare Phone Number and ask if they cover Ozempic

The phone number for United Healthcare is 1-844-444-6222.

How is Ozempic Covered by United Healthcare?

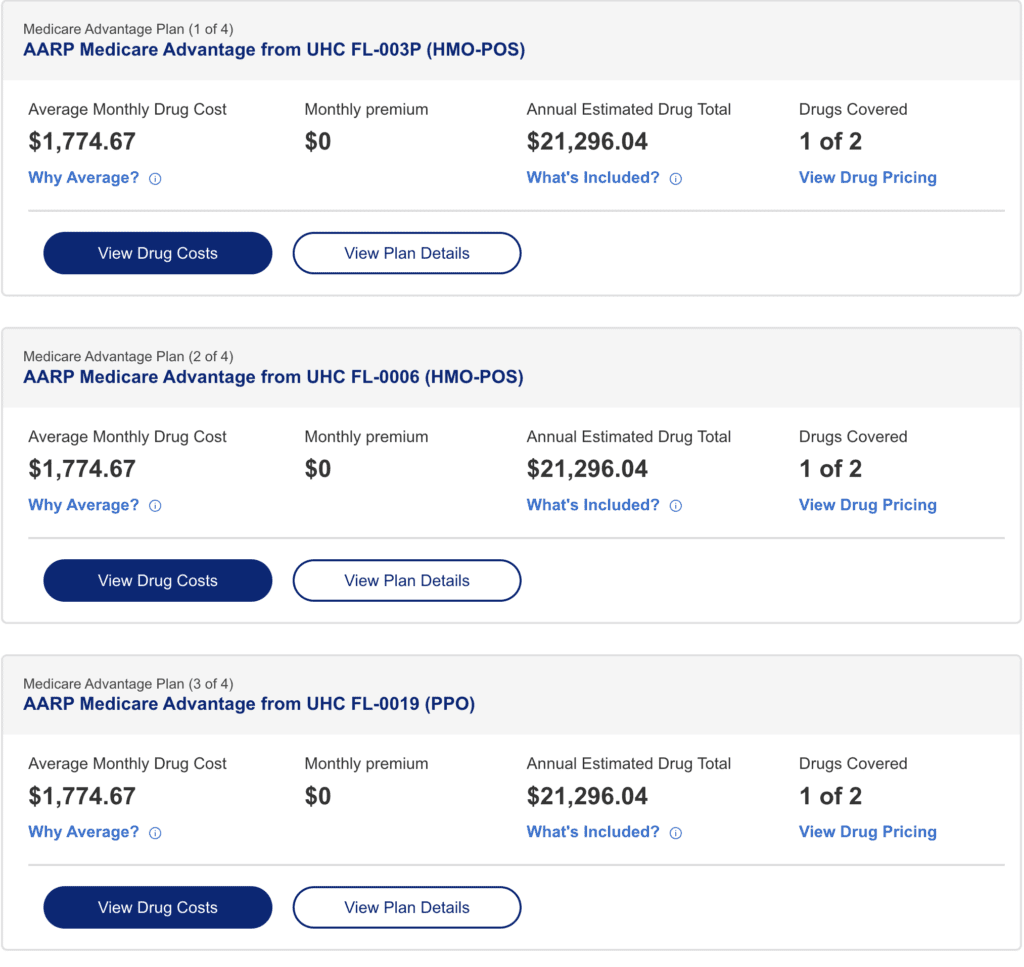

Below is a chart of Medicare plans including AARP Medicare advantage PPO plans. It shows the coverage of Ozempic.

Eligibility Criteria for Ozempic Coverage

To be eligible for Ozempic coverage under United Healthcare plans, patients must typically meet certain criteria, such as:

- Diagnosis Confirmation: A confirmed diagnosis of Type 2 diabetes.

- Prior Authorization: In many cases, United Healthcare requires prior authorization for Ozempic, ensuring that it is necessary and appropriate for the patient’s condition.

- Treatment History Review: An assessment of the patient’s previous diabetes treatments, showing that other medications have been tried and were ineffective or unsuitable.

Plan-Specific Coverage Details

Coverage for Ozempic can vary significantly based on the specific United Healthcare plan. Some plans may cover the medication fully, while others might require a copayment or have certain limitations. It’s important for patients to review their individual plan details or contact United Healthcare directly for the most accurate information.

Step-by-Step Guide to Accessing Ozempic Coverage

- Consult with Your Healthcare Provider: Discuss your need for Ozempic with your doctor, who can provide a prescription and assist with the prior authorization process if required.

- Review Your Insurance Plan: Examine your United Healthcare plan details to understand the coverage specifics for Ozempic.

- Submit Necessary Documentation: Ensure all required documents, such as the prescription and prior authorization forms, are submitted to United Healthcare.

- Follow Up with United Healthcare: Stay in contact with United Healthcare to track the status of your coverage request and address any additional requirements.

Financial Assistance and Alternative Options for Ozempic

For patients who face challenges in obtaining coverage for Ozempic under their United Healthcare plan, several options may be available:

- Patient Assistance Programs: Pharmaceutical companies often offer assistance programs to help patients afford their medications.

- Generic Alternatives: Consult with your healthcare provider about possible generic alternatives that might be more affordable.

- Discount Programs: Look for discount programs or coupons that may reduce the out-of-pocket cost of Ozempic.

Navigating Ozempic Coverage with Confidence

Understanding the intricacies of United Healthcare coverage for Ozempic is key to successfully managing your diabetes treatment. By familiarizing yourself with the eligibility criteria, plan-specific details, and alternative financial options, you can navigate the process with greater ease and confidence.

Will United Healthcare pay for Ozempic?

Yes, United Healthcare provides coverage for Ozempic as part of its prescription drug benefits. However, it’s important to note that the extent and nature of the coverage can vary depending on your specific insurance plan and its formulary, which is a list of covered medications. Ozempic, an FDA-approved medication for treating Type 2 diabetes, typically costs between $1,000 to $1,200 or more for one pen. Health insurance, including plans from United Healthcare, may cover Ozempic if it is being used as a treatment for Type 2 diabetes.

It’s also worth noting that certain United Healthcare plans may require prior authorization for Ozempic. This means that your healthcare provider must obtain approval from United Healthcare before prescribing the medication. In addition, some plans may implement step therapy protocols. These protocols could require patients to try alternative medications before Ozempic is approved for coverage.

In summary, while United Healthcare does offer coverage for Ozempic, the specific details of this coverage, including the extent of coverage and any additional requirements such as prior authorization or step therapy, can vary significantly based on your individual plan.

Does United Healthcare cover Ozempic for Prediabetes?

Generally, most insurance plans, including those from major providers like United Healthcare, tend to cover Ozempic for its FDA-approved use in treating type 2 diabetes. However, coverage for off-label uses, such as for weight loss or conditions like prediabetes, is less common.

For the most accurate and up-to-date information, it’s recommended to directly contact United Healthcare or consult with a healthcare provider. They can provide specific details about coverage based on your individual insurance plan and medical needs.

Disclaimer: The content in this article is provided for general informational purposes only. It may not be accurate, complete, or up-to-date and should not be relied upon as legal, financial, or other professional advice. Any actions or decisions taken based on this information are the sole responsibility of the user. Medicare-365 and/or BL Monahan Inc expressly disclaims any liability for any loss, damage, or harm that may result from reliance on this information. Please note that this article may contain affiliate endorsements and advertisements. The inclusion of such does not indicate an endorsement or approval of the products or services linked. Medicare-365 and/or BL Monahan Inc does not accept responsibility for the content, accuracy, or opinions expressed on any linked website. When you engage with these links and decide to make a purchase, we may receive a percentage of the sale. This affiliate commission does not influence the price you pay, and we disclaim any responsibility for the products or services you purchase through these links.