If you’re here, you might have heard about MaineCare and are wondering what all the buzz is about. Well, let me tell you, you’re in for a treat! As we embrace the golden years of our lives, understanding the healthcare options that stand by us becomes incredibly important. Let’s take a leisurely stroll through the world of MaineCare together.

What is MaineCare and its significance for the elderly?

Let’s get straight to it: MaineCare isn’t some newfangled concept. It’s Maine’s own special version of Medicaid. Think of it as a comforting blanket, there to keep you warm and protected when the temperatures drop.

Why should this matter to you? As the years go by, our needs change. It’s not just about reading the morning paper without glasses or enjoying those early bird specials. It’s about ensuring we have access to the medical services we deserve without causing any undue stress to our savings. And that’s where MaineCare comes in, like a trusted old friend, ensuring that our later years are filled with peace and security.

The importance of long-term care options as one ages.

Let’s talk about the heart of the matter: long-term care. This isn’t just about finding a place to stay; it’s about ensuring our days are filled with quality, respect, and the choices we want. As time goes on, certain things might become a bit more challenging. Perhaps walking long distances isn’t as easy as it used to be, or maybe cooking every meal feels a tad exhausting.

But here’s the beautiful part: needing a bit of assistance doesn’t mean giving up our independence. That’s the magic of long-term care options. Whether it’s a bit of help at home or joining a community of like-minded folks, there’s a perfect fit for everyone.

And why is this so crucial? Because each one of us, no matter our age, deserves to live our days with joy, comfort, and dignity. Embracing long-term care is our way of ensuring that our golden years truly shine.

Long Term Care Insurance

The very essence of insurance lies in its promise of protection, a shield against unforeseen challenges. Long term care insurance, in particular, offers a unique blend of security and support. Let’s unpack what it entails and how it intertwines with MaineCare.

What is Long Term Care Insurance?

- Definition: A specific insurance policy designed to cover the costs of long-term care services, whether medical or non-medical.

- Coverage Areas: Includes home care, assisted living, adult daycare, respite care, hospice care, nursing homes, and Alzheimer’s care facilities.

- Benefit Trigger: Conditions or situations, such as the inability to perform certain Activities of Daily Living (ADLs), that activate the policy’s benefits.

At its core, long-term care insurance is about foresight. As the sands of time shift and the challenges of age or health conditions loom, this insurance acts as a protective umbrella. It’s not just about medical needs; it’s about ensuring that daily life, with its tasks and demands, remains manageable and comfortable. Whether it’s assistance at home or specialized care at a facility, long-term care insurance ensures that resources are at hand when needed the most.

Basics of MaineCare

Ah, MaineCare! A beacon of hope for many in our beautiful Pine Tree State. But what exactly is it? Let’s break it down together.

Overview of MaineCare

MaineCare, at its core, is our state’s response to Medicaid. Now, before your eyes glaze over with the mention of official terms, let me simplify it. Do you remember the good ol’ community potlucks, where everyone chipped in to create a feast? Think of Medicaid as a national potluck, where every state brings its own dish to the table. And MaineCare? That’s our state’s special recipe, tailored to the unique needs and flavors of Mainers.

How MaineCare differs from Medicaid

You might be thinking, “If MaineCare is our version of Medicaid, why not just call it Medicaid?” A valid question! While both programs aim to provide essential health services to those in need, each state has the freedom to customize its offerings. That’s where MaineCare shines. It’s specially designed with the rhythms and nuances of Maine life in mind, ensuring that residents of our state receive care that resonates with our lifestyle and values.

Administered benefits by the Department of Health and Human Services (DHHS)

Behind every successful program is a team of dedicated individuals ensuring everything runs smoothly. For MaineCare, that honor goes to the Department of Health and Human Services (DHHS). Think of DHHS as the caretakers of MaineCare. They ensure the program stays up-to-date, accessible, and effective for all Mainers. From setting guidelines to processing applications, DHHS is the backbone ensuring MaineCare remains a trusted resource for our community.

“Maine Long Term Care Insurance Partnership in 2023” – Updated Guidelines

- Partnership Program: A collaboration between the state and private insurance companies to offer long-term care insurance policies that also provide Medicaid Asset Protection.

- Asset Protection: For every dollar that a partnership policy pays out in benefits, an equal amount of assets will be disregarded when determining MaineCare eligibility.

- Inflation Protection: Updated guidelines in 2023 emphasize the importance of inflation protection, ensuring that benefits align with rising costs.

The Maine Long Term Care Insurance Partnership is akin to a symphony, where the state and private insurers come together in harmony. The objective? To strike the right balance between personal insurance and the safety net of MaineCare. With the 2023 updates, this partnership has further evolved to reflect the changing economic landscape. The emphasis on inflation protection ensures that benefits remain relevant, and the asset protection feature acts as a bridge, ensuring that when the time comes, transitioning to MaineCare is seamless and efficient.

Eligibility for MaineCare

Stepping into the world of MaineCare might feel like a dance where you’re not quite sure of the steps. But don’t fret; I’m here to guide you through the rhythm and beats of MaineCare eligibility. So, put on your dancing shoes, and let’s waltz through this together!

Overview of Eligibility Criteria

MaineCare, in its essence, is designed with the heart and soul of Mainers in mind. To ensure that the program reaches those who truly need it, there are specific criteria to meet. These criteria take into account factors like income, the number of family members in your household, age, and certain health conditions.

Income Limits for MaineCare Eligibility

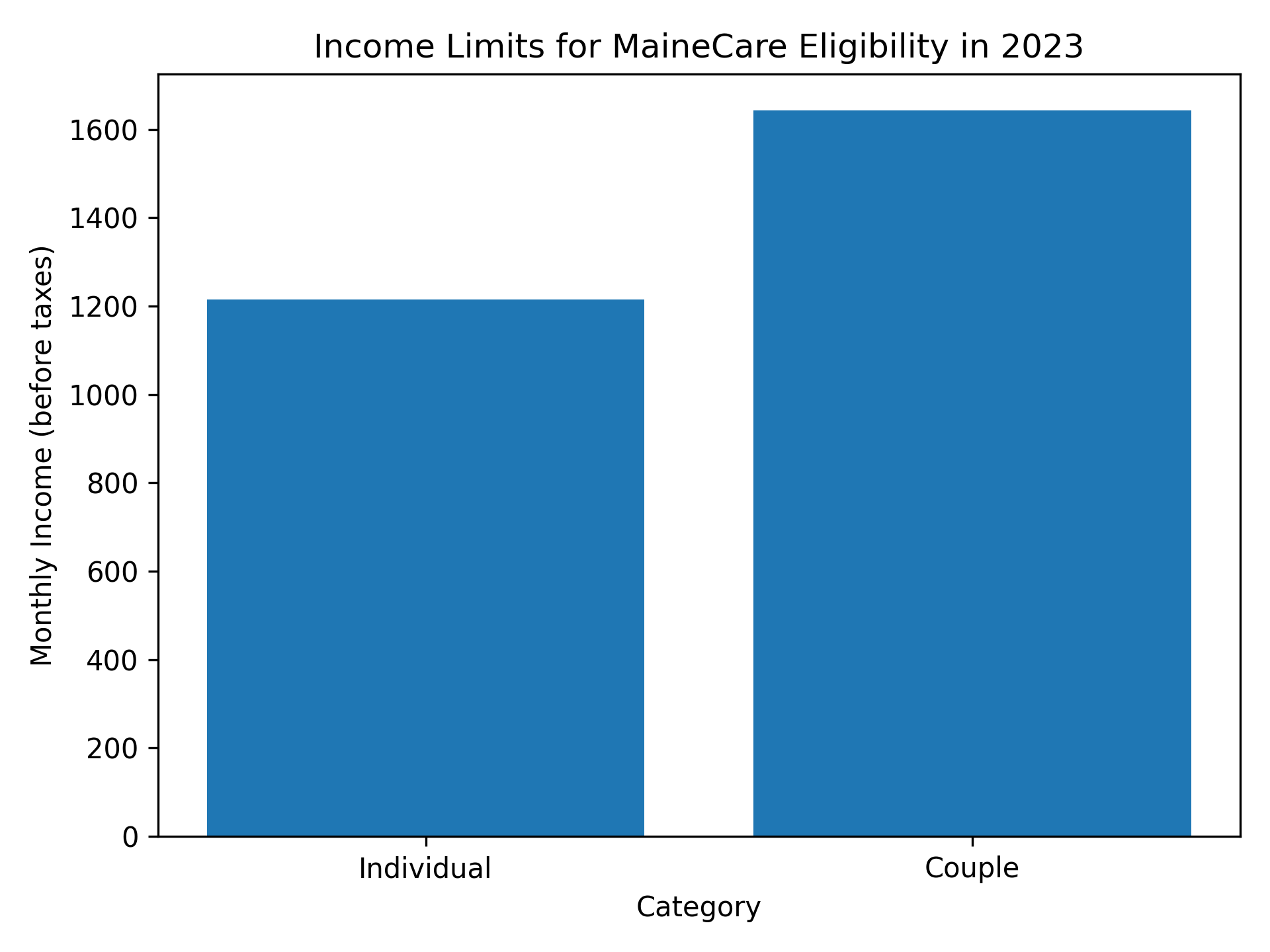

When we talk about MaineCare, the question of income often takes center stage. Simply put, your household income is a significant factor in determining whether you’re eligible for MaineCare. For a clearer picture:

- For an individual, if your monthly income (before taxes) is up to $1,215, you may be eligible.

- For a couple, the limit is set at $1,643 per month.

It’s like setting a budget for a trip; if you’re within the limit, you’re good to go! But, if you’re slightly over, don’t lose heart. There might be other considerations that could work in your favor.

“Eligibility in 2023” – Updated Guidelines

Ah, 2023! A year that brought with it a gentle breeze of change to the MaineCare guidelines. Here’s the scoop:

- The income limits saw a slight adjustment to account for inflation and economic shifts, ensuring that MaineCare remains accessible to those in need.

- Asset exemptions increased, meaning more of your assets, like certain properties and savings, won’t be counted against your eligibility.

- The monthly income limit for individuals was adjusted to $1,215, and for couples, it’s now at $1,643.

These updates, like the changing tides, ensure that MaineCare remains relevant and supportive, adapting to the times and needs of its residents.

MaineCare Benefits

MaineCare stands as a testament to our commitment to ensuring that every Mainer receives the care they deserve. But what does this care encompass? Let’s dive into the specifics.

Assistance with Long-Term Care

- Home-based Assistance:

- Daily tasks: Assistance with activities like bathing, dressing, and meal preparation.

- Medication management: Ensuring timely and correct medication intake.

- Regular health check-ups: Periodic visits to monitor health.

- Specialized Care:

- Skilled nursing facilities: Dedicated centers for those requiring continuous medical attention.

- Therapeutic services: Rehabilitation and therapy for various conditions.

- Rehabilitation centers: Facilities to aid recovery and restore normalcy.

MaineCare understands the importance of feeling secure and cared for, especially in the later stages of life. Whether you’re someone who cherishes the familiar surroundings of home but needs a little help, or you require specialized medical attention, MaineCare has got you covered. It’s about ensuring that the golden years are truly golden, with every need addressed and every comfort provided.

Medically and Financially Eligible Conditions for Benefits

- Medical Needs:

- Daily care assessment: Determining the level of assistance required for everyday tasks.

- Specialized care: Evaluating the need for intensive medical attention for specific conditions.

- Financial Eligibility:

- Monthly income limits: $1,215 for individuals and $1,643 for couples.

- Asset considerations: Exemptions for primary residences valued up to $858,000 and specific other assets.

MaineCare operates on a foundation of fairness and inclusivity. It’s not just about assessing medical needs, but also understanding an individual’s financial situation. The goal is to ensure that those who genuinely need the support of MaineCare can access it. From income evaluations to understanding an individual’s assets, MaineCare’s eligibility conditions are tailored to make quality care accessible.

The Complexity of MaineCare Rules Regarding Long-Term Care

- Asset Transfers: Policies to ensure assets are fairly distributed and utilized.

- Waiting Periods: Defined durations post-application before the onset of benefits.

- Penalties: Consequences laid out for deviations from guidelines or misrepresentations.

- Pro Tip: Stay updated with MaineCare’s evolving guidelines. This proactive approach ensures you’re always in the know and can make informed decisions.

Navigating the intricacies of MaineCare’s long-term care rules might seem daunting at first glance. However, these guidelines are in place to maintain the integrity and efficiency of the program. They ensure that the resources are optimally utilized for the benefit of all Mainers. By understanding and adhering to these rules, beneficiaries can enjoy a seamless and enriching experience with MaineCare.

Assets and Financial Planning

Understanding your assets and the nuances of financial planning can be the difference between a smooth sail and choppy waters when it comes to MaineCare. Let’s demystify these crucial components together.

Exempt Assets in 2023 for an Applicant in Maine

- Primary Residence: A home valued up to $858,000 is exempt if the applicant intends to return to it.

- Personal Possessions: Items like clothing, furniture, and personal belongings.

- Vehicles: One car, regardless of its value.

- Life Insurance: Policies with a face value of up to $1,500.

- Prepaid Funeral Plans: Fully exempt, allowing for peace of mind in future planning.

- Small Life Insurance Policies and Specific Annuities: Under certain conditions.

Diving into the details, assets play a significant role in determining MaineCare eligibility. But here’s the silver lining: not all assets count against you. Maine, in its wisdom, has identified certain assets as ‘exempt’. This means that these assets won’t be considered when determining your eligibility for MaineCare. It’s like having certain items not count when you’re trying to stick to a luggage weight limit for a flight. This approach ensures that individuals don’t have to relinquish all they hold dear to access the care they need.

The Importance of Financial Planning for Long-Term Care

- Understanding Costs: Grasping the potential expenses of long-term care, both immediate and future.

- Asset Protection: Strategies to protect your assets while ensuring MaineCare eligibility.

- Legal Tools: Utilizing tools like trusts and power of attorney for asset management and protection.

Financial planning isn’t just about counting pennies; it’s about painting a clearer picture of your future. Long-term care, while essential, comes with its own set of costs. Planning ahead ensures that you’re prepared, not just for today, but for the many tomorrows to come. It’s about making informed decisions, understanding potential expenses, and putting measures in place to protect what you’ve worked so hard to build. Think of it as charting out a map for a journey, ensuring that you have all you need for the road ahead.

Spousal Rules

Ah, the bond of marriage! It’s a journey of love, companionship, and mutual support. And when it comes to MaineCare, this beautiful bond plays a pivotal role in determining eligibility and benefits. Let’s navigate the waters of spousal rules together.

Protecting the Financial Interests of the Spouse

- Community Spouse Resource Allowance (CSRA): A provision that ensures the spouse not applying for MaineCare has a certain amount of assets protected.

- Minimum Monthly Maintenance Needs Allowance (MMMNA): Ensures that the community spouse has enough monthly income for their needs.

- Fair Hearings: A provision allowing spouses to request additional assets or income if the standard allowances are insufficient.

When one spouse requires the assistance of MaineCare, it’s natural to wonder about the financial implications for the other. Here’s the good news: MaineCare has provisions in place to ensure that the community spouse (the one not applying for benefits) isn’t left in a lurch. These provisions act as safeguards, ensuring that while one partner receives the care they need, the other continues to live with financial security and dignity. It’s like ensuring that both partners in a dance have stable footing, even if one is leading.

“Spousal Rules in 2023” – Updated Guidelines

- CSRA Increase: In 2023, the maximum Community Spouse Resource Allowance saw an increment, offering more protection for assets.

- MMMNA Adjustments: The Minimum Monthly Maintenance Needs Allowance has been adjusted to reflect the economic landscape and cost of living.

- Annuity Rules: Updated regulations on how annuities are treated for MaineCare eligibility.

The dance of life is ever-evolving, and so are the rules that govern it. In 2023, MaineCare introduced a few tweaks to the spousal rules to ensure they remain relevant and supportive. These updates reflect the changing economic scenarios and the aim to provide optimal protection to spouses. It’s like adjusting the rhythm to ensure the dance remains harmonious and fluid.

Application Process for Long-Term Care MaineCare

The idea of diving into the application process might feel a tad daunting, akin to prepping for a big journey. But fear not! With the right map and a trusty guide by your side (that’s me!), we’ll navigate these waters with ease. Ready? Let’s set sail!

Initiating the Application Process

- Where to Apply: Local Department of Health and Human Services (DHHS) office or the Office for Family Independence.

- Documents Required: Proof of identity, income, assets, and medical records.

- Initial Assessment: Conducted to determine the level of care required.

Steps to Follow for a Successful Application

- Initial Research: Understand the basics of MaineCare and the specific requirements for long-term care applications.

- Document Collection: Gather necessary documents such as proof of identity, income, assets, and medical records.

- Application Submission: Submit your application through the local Department of Health and Human Services (DHHS) office or the Office for Family Independence.

- Attend the Assessment: Participate in the initial assessment, which determines the level of care required.

- Regular Follow-up: Stay in touch with DHHS, keeping an eye out for any updates or additional document requests.

- Decision Notification: Once DHHS has reviewed the application, you’ll receive a notification detailing their decision.

- Understand Your Benefits: If approved, familiarize yourself with the specific benefits and services available to you.

The journey to a successful MaineCare application is sequential, with each step building on the previous one. It’s like following a trail, where every marker leads you closer to your destination. By adhering to these steps and ensuring meticulous attention to detail, you pave the way for a smooth and efficient application experience.

Navigating the Waiting Period

- Review Time: Typically, DHHS takes up to 45 days to review applications, though it can extend to 90 days for disability determinations.

- Status Updates: Applicants can check their application status online or by contacting DHHS.

- Approval/Rejection: Notification is sent once a decision is made.

Patience, they say, is a virtue. Once your application is submitted, there’s a period of anticipation, akin to waiting for the tide to turn. DHHS meticulously reviews every application to ensure that those who truly need MaineCare’s support receive it. While the waiting period might feel lengthy, rest assured, it’s a thorough process. And just like how a sailor keeps an eye on the horizon, you can keep track of your application’s status, eagerly awaiting the moment when the decision is unveiled.

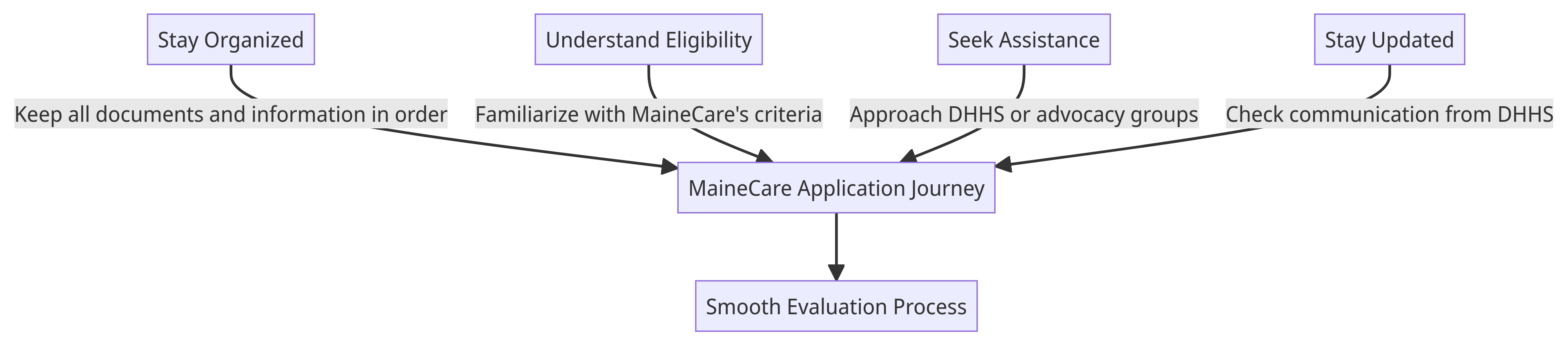

Tips for a Smooth Application Experience

- Stay Organized: Keep all documents and information in order, readily accessible.

- Understand Eligibility: Familiarize yourself with MaineCare’s eligibility criteria for long-term care to ensure you meet the requirements.

- Seek Assistance: Don’t hesitate to approach local DHHS offices or advocacy groups if you need help or clarification during the application process.

- Stay Updated: Regularly check for any communication from DHHS and respond promptly to any requests for additional information.

Embarking on the MaineCare application journey requires preparation. Think of these tips as your trusty compass, guiding you through each step, and ensuring you stay on course. From gathering your documents to understanding the nuances of eligibility, being well-prepared ensures that your application sails smoothly through the evaluation process.

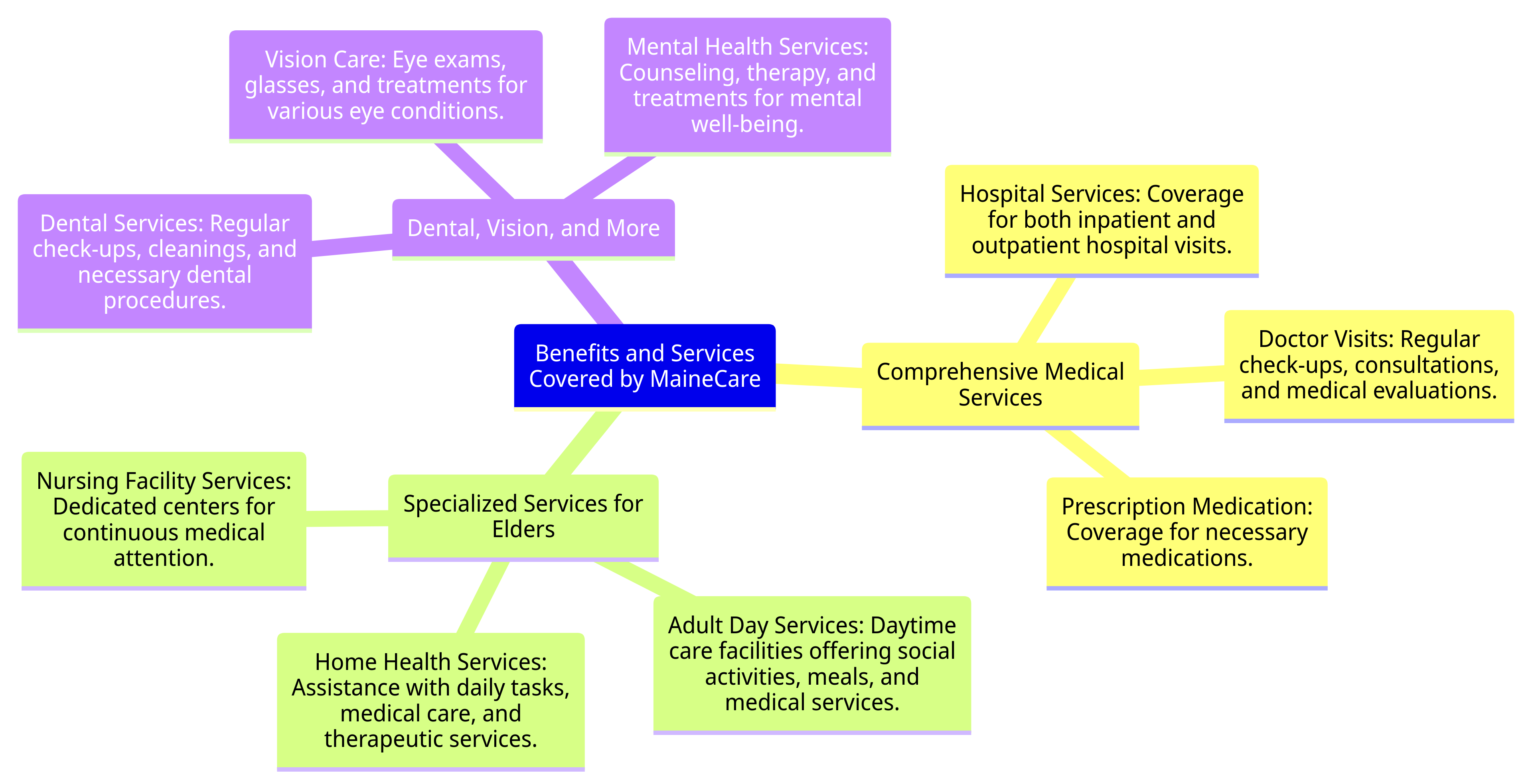

Benefits and Services Covered by MaineCare

MaineCare isn’t just a name on paper; it’s a treasure chest filled with a plethora of benefits and services tailored to support Mainers. But what lies within this chest? Let’s unlock it and explore the bounty that awaits.

Comprehensive Medical Services

- Hospital Services: Coverage for both inpatient and outpatient hospital visits.

- Doctor Visits: Regular check-ups, consultations, and medical evaluations.

- Prescription Medication: Coverage for necessary medications, ensuring health isn’t compromised due to costs.

MaineCare understands that health is multifaceted. Whether it’s a routine check-up, an unexpected hospital stay, or the medications that keep us going, MaineCare ensures that every facet is covered. It’s like having a safety net that catches you irrespective of the medical challenge you face, ensuring that health remains paramount.

Specialized Services for Elders

- Home Health Services: Assistance with daily tasks, medical care, and therapeutic services right at home.

- Adult Day Services: Daytime care facilities offering social activities, meals, and medical services.

- Nursing Facility Services: Dedicated centers for those requiring round-the-clock medical attention and care.

Growing older comes with a unique set of needs and challenges. MaineCare, with its keen understanding, offers services tailored for our seasoned citizens. Whether it’s the comfort of receiving care at home, the joy of socializing and engaging in activities at an adult day center, or the comprehensive care provided by nursing facilities, MaineCare ensures that the golden years are truly enriching.

Dental, Vision, and More

- Dental Services: Regular check-ups, cleanings, and necessary dental procedures.

- Vision Care: Eye exams, glasses, and treatments for various eye conditions.

- Mental Health Services: Counseling, therapy, and treatments tailored for mental well-being.

MaineCare’s embrace extends beyond just primary medical care. It recognizes that health is holistic. From flashing a confident smile thanks to dental care, to seeing the world clearly with vision support, to ensuring mental well-being, MaineCare’s spectrum of services is all-encompassing. It’s about cherishing every aspect of health, ensuring that every Mainer thrives.

Rights and Protections for MaineCare Recipients

Navigating the world of MaineCare isn’t just about understanding the benefits and application process; it’s also about recognizing and cherishing the rights and protections afforded to every recipient. Let’s take a moment to shine a light on these pivotal aspects.

Individual Rights as a MaineCare Recipient

- Equal Treatment: Every MaineCare recipient is entitled to fair and equal treatment, irrespective of age, race, gender, or condition.

- Confidentiality: Personal and medical information remains private and is protected by MaineCare.

- Choice of Providers: Freedom to choose from a list of MaineCare-affiliated medical providers and facilities.

- Access to Information: The right to be informed about any changes, updates, or decisions regarding MaineCare benefits.

Being a part of the MaineCare family means being enveloped in a world of rights designed to ensure dignity, respect, and empowerment. It’s about knowing that you’re not just a number but an individual whose needs, preferences, and rights are held in the highest regard. Just as every Mainer has the right to bask in the beauty of our sunsets and coastlines, every MaineCare recipient has rights that ensure their journey is smooth, respectful, and empowering.

Protections Against Discrimination

- Non-Discrimination Policy: MaineCare ensures that no individual is discriminated against based on race, color, national origin, disability, age, or sex.

- Accessible Services: Facilities and services are accessible to individuals with disabilities, ensuring everyone receives the care they need.

- Language Assistance: For those whose primary language isn’t English, MaineCare provides translation and interpretation services.

MaineCare stands tall as a beacon of inclusivity and fairness. It’s not just about providing medical benefits; it’s about ensuring that these benefits are accessible to everyone, regardless of their background, challenges, or language. Think of MaineCare as a vast, welcoming home where every room is open, every service is accessible, and every individual is treated with the respect and care they deserve.

Advocacy and Support

- Right to Appeal: If unhappy with a decision made by MaineCare, recipients have the right to appeal.

- Support Services: Assistance is available for those who need help understanding their rights or navigating the MaineCare landscape.

- Feedback Channels: MaineCare values feedback and has channels for recipients to voice concerns, suggestions, or appreciation.

Being a part of MaineCare is akin to being in a partnership. It’s a two-way street. While MaineCare provides a plethora of benefits, it also listens, values feedback, and stands by its recipients every step of the way. It’s about ensuring that every voice is heard, every concern is addressed, and every individual feels valued and supported.

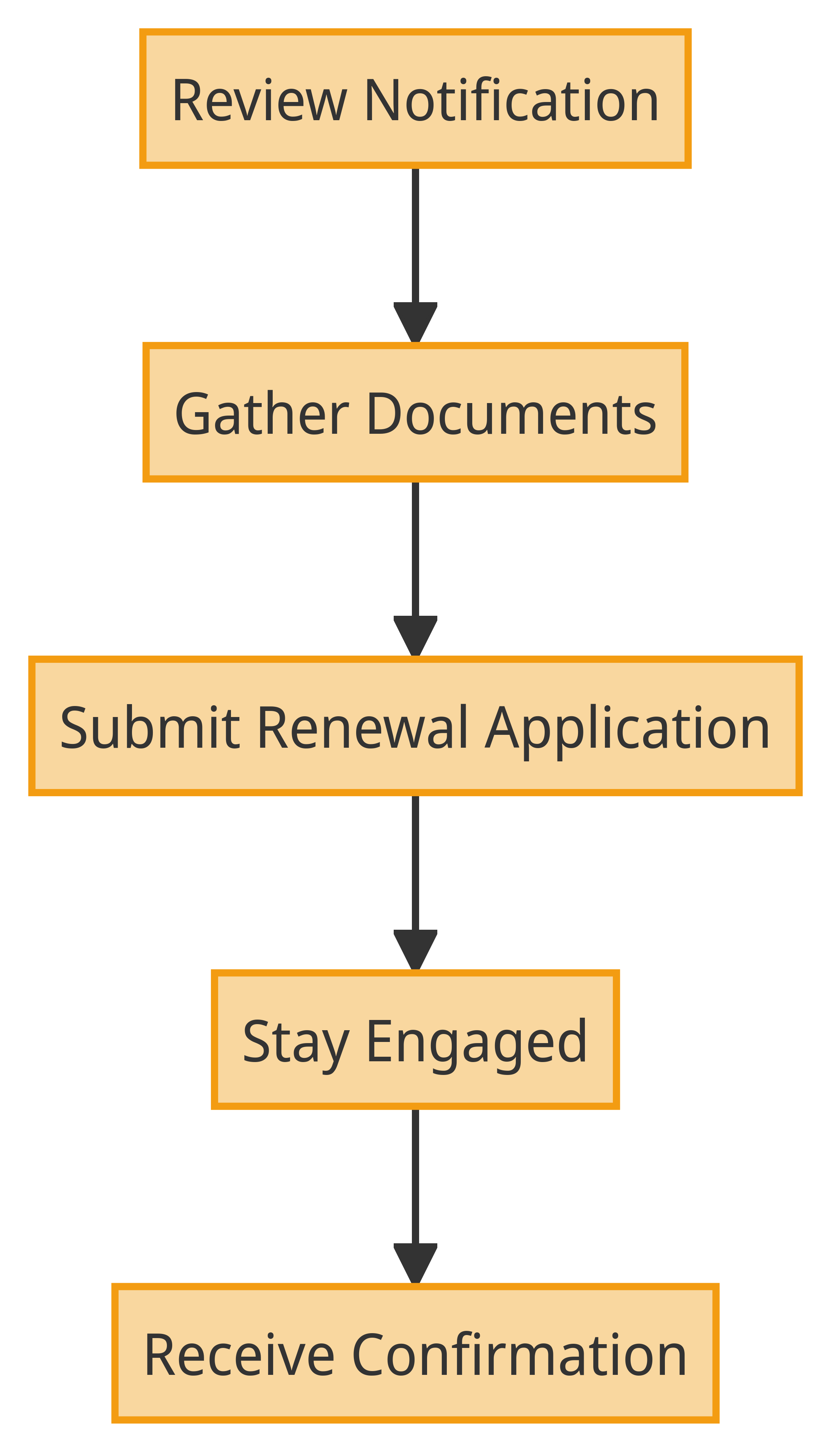

Renewing MaineCare Benefits

Life is a journey filled with cycles and seasons, and just like the trees shed their leaves only to bloom again, MaineCare benefits too require periodic renewal. Ensuring continuity in these benefits is vital, and understanding the renewal process is key. Let’s dive in.

Importance of Renewing on Time

- Continuous Coverage: Timely renewal ensures that there’s no disruption in the medical services and support you receive.

- Financial Security: Avoid unexpected medical bills and expenses by ensuring your coverage is always active.

- Peace of Mind: Knowing that you’re consistently protected under MaineCare alleviates stress and provides peace of mind.

Renewing your MaineCare benefits on time is akin to tuning a musical instrument regularly. It ensures that the melodies of support and care continue uninterrupted. Without timely renewal, you risk hitting discordant notes in your healthcare journey, from unexpected medical expenses to potential gaps in essential services. It’s all about ensuring the symphony of care plays on harmoniously.

How to Know When It’s Time to Renew

- Notification: MaineCare sends out renewal notifications, usually a month before the renewal date.

- Account Monitoring: Keep an eye on your online MaineCare account, where renewal dates and reminders are posted.

- Calendar Reminders: Mark your renewal date on your calendar to stay ahead of the curve.

Wondering when it’s time to renew? MaineCare’s got your back! Think of it as a friendly nudge, a gentle reminder ensuring you’re always in the loop. Whether it’s a notification in your mailbox, a reminder on your online account, or a self-set alert on your calendar, these cues ensure you’re always a step ahead, ready to renew.

Steps for Renewal and Avoiding Gaps in Healthcare Coverage

- Review Notification: Thoroughly read the renewal notification sent by MaineCare, noting any specific requirements or changes.

- Gather Documents: Assemble any necessary documents or information required for the renewal process.

- Submit Renewal Application: Complete and submit the renewal form either online, via mail, or in person.

- Stay Engaged: Keep an eye out for any communication from MaineCare after submitting the renewal. They might request additional information or clarification.

- Receive Confirmation: Once the renewal process is complete, MaineCare will send a confirmation, solidifying your continued benefits.

The renewal process, with its steps and guidelines, is designed to be streamlined and user-friendly. Like retracing a familiar path, each step is clear, leading you to the desired destination of continued MaineCare benefits.

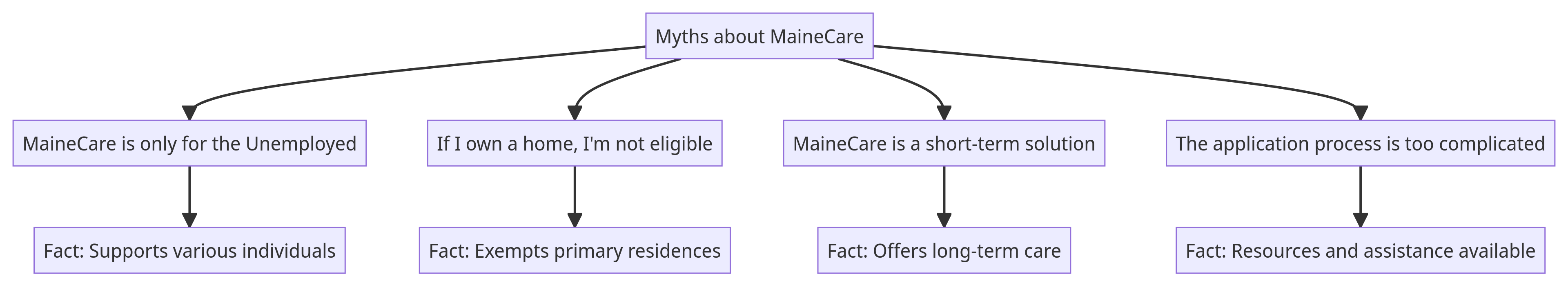

Common Misconceptions about MaineCare

Every great initiative, no matter how beneficial, often finds itself surrounded by myths and misconceptions. MaineCare, with all its facets, is no exception. Let’s dispel some of these myths together and shine a light on the truths behind them.

“MaineCare is only for the Unemployed”

- Fact: MaineCare supports various individuals, including those who are employed but may have limited income or specific medical needs.

It’s a common misconception that MaineCare is solely for those without jobs. The truth? MaineCare is designed to support a broad spectrum of Mainers, including many who work. Think of it as a safety net, ensuring that no one falls through the cracks, whether they’re employed or not.

“If I own a home, I’m not eligible.”

- Fact: MaineCare has provisions that exempt primary residences (up to a certain value) from being counted against eligibility.

Owning a home is often seen as a sign of financial stability. But does it disqualify you from MaineCare? Not necessarily! MaineCare understands the importance of a home – it’s not just an asset; it’s a sanctuary. And so, your primary residence (up to a specific value) won’t hinder your eligibility.

“MaineCare is a short-term solution.”

- Fact: MaineCare offers long-term care solutions and support, ensuring that recipients receive consistent care over extended periods.

Some view MaineCare as a fleeting solution, a temporary band-aid. But in reality, it’s a steadfast companion, offering long-term care and support. Whether you’re looking for assistance today or foreseeing a need in the future, MaineCare is there to walk the journey with you.

“The application process is too complicated.”

- Fact: While the application process requires specific information and documentation, resources and assistance are available to guide applicants through it.

It’s easy to feel overwhelmed by paperwork and procedures. But fear not! While the MaineCare application does require details and documents, there’s ample support available to guide you through. With the right information and a touch of guidance, the path becomes much clearer.

Recent Changes and Important Notices

Change is the only constant, they say. As the world evolves, so do the guidelines and provisions of programs like MaineCare. Staying abreast of these changes ensures that you’re always in the know, empowered to make informed decisions. Let’s explore the recent shifts together.

Separation of Continuous Coverage Provision from the COVID-19 Public Health Emergency

- Prior Provision: During the COVID-19 public health emergency, MaineCare had a continuous coverage provision, ensuring no lapses in coverage.

- Current Status: As the public health emergency evolves, this continuous coverage provision has been separated, meaning renewals and eligibility checks will resume as per standard protocols.

The world witnessed a seismic shift with the advent of the COVID-19 pandemic. During these unprecedented times, MaineCare, in its commitment to ensuring uninterrupted care, had provisions in place to provide continuous coverage. But as we navigate the aftermath and the evolving landscape of the public health emergency, certain adjustments have been made. The continuous coverage provision, which acted as a protective shield during the peak of the pandemic, has now been re-evaluated. This means that the standard protocols of renewals and eligibility checks have resumed, ensuring that the program remains sustainable and beneficial for all.

Impacts of Recent Legislative Changes on MaineCare Beneficiaries

- Legislative Updates: Various legislative changes have been introduced that impact the structure and provisions of MaineCare.

- Beneficiary Impacts: These changes can influence eligibility criteria, the range of services covered, and the overall benefits available to MaineCare recipients.

Legislation, like the tides, is ever evolving. As new laws and regulations come into play, programs like MaineCare adapt, ensuring that they remain relevant, effective, and in line with the broader legislative landscape. These legislative changes, whether they pertain to eligibility, services, or overall benefits, have direct implications for MaineCare beneficiaries. It’s essential to stay informed about these changes, understand their nuances, and adjust one’s sails accordingly.

Conclusion

The journey of life, with its twists and turns, requires foresight, especially when it comes to our health and well-being in the golden years. MaineCare stands as a beacon, guiding Mainers through the intricacies of long-term care, ensuring that every chapter of life is lived with dignity and support. As you reflect on your path ahead, consider your long-term care needs, and remember that resources and helplines are just a call away, ready to assist. Embrace the promise of a secure future and let MaineCare be your steadfast companion.