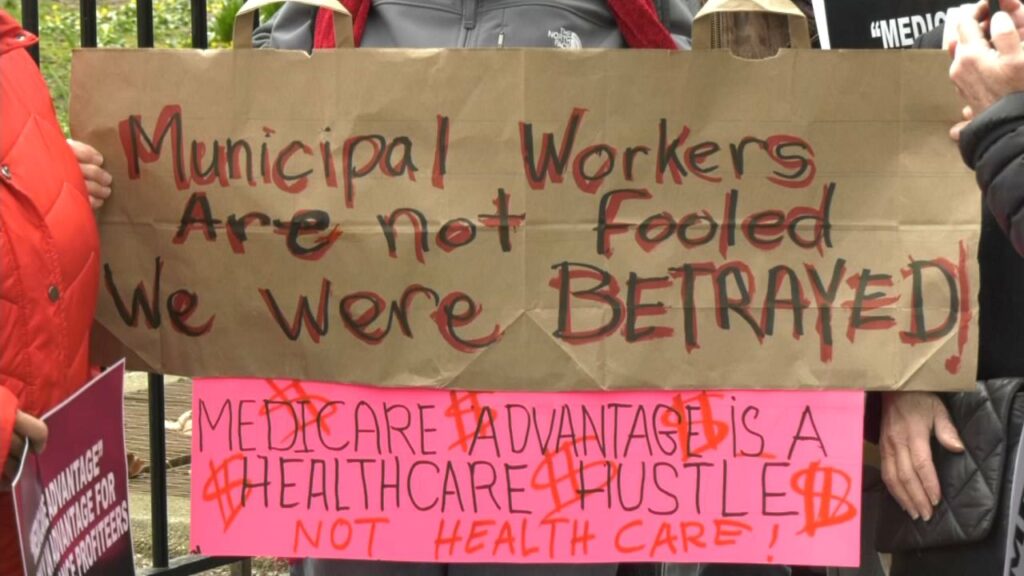

The concerns raised by the retired municipal workers regarding the new privatized healthcare plan are understandable and warrant attention. It is crucial to address their grievances and find a solution that ensures their healthcare needs are met without causing undue financial burdens. While Mayor Eric Adams has emphasized the benefits of the Medicare Advantage PPO plan, it is important to carefully consider the retirees’ perspective and explore viable alternatives.

Medicare Advantage Plan Restrictions

The retirees’ main contention is that the Medicare Advantage plan restricts their access to doctors and imposes additional hurdles in receiving necessary medical care. Their concerns about prior authorizations and pre-visit confirmations, which are determined by insurance companies rather than healthcare professionals, are valid. Maintaining a system where doctors have the final say in determining what is medically necessary is crucial for the retirees’ peace of mind and overall well-being.

In light of these concerns, it is worth examining “Option C,” which the retirees propose as an alternative solution. If Option C can indeed maintain premium-free senior care while saving the city $350 million, it presents a compelling argument. The city should thoroughly evaluate this option, taking into account the retirees’ financial circumstances and their dedicated service to the city.

It is crucial for the City Council to carefully review the proposed plan and consider its impact on the retired municipal workers. If there are legitimate concerns regarding the privatized healthcare plan, the City Council should engage in open dialogue with the retirees and their representatives to seek a mutually agreeable solution. Legal action should be a last resort, and every effort should be made to find a resolution that protects the rights and well-being of these elderly and disabled civil servants.

During the opt-out period from May 1 to June 30, it is important for the retirees to thoroughly assess their options and make informed decisions about their healthcare coverage. They should consider seeking independent advice and engaging with organizations that can provide assistance in navigating the complex healthcare landscape.

It is essential for all stakeholders involved to approach this issue with empathy and a commitment to finding a fair resolution. The retirees deserve healthcare coverage that ensures their well-being without imposing unnecessary financial burdens or restricting their access to quality care. By engaging in open dialogue, considering alternative

options, and prioritizing the retirees’ needs, it is possible to arrive at a solution that addresses their concerns and maintains the city’s fiscal responsibilities.

- Specific changes and benefits: The new Medicare Advantage PPO plan offers a lower deductible, a cap on out-of-pocket expenses, and introduces new benefits compared to the previous healthcare plan. The exact details of these changes and benefits should be obtained from the plan documentation or relevant authorities.

- Access to healthcare providers: The new plan may impact access to healthcare providers, including current doctors and specialists. Retirees should inquire about the network of healthcare providers under the new plan and check if their preferred doctors or specialists are included. They should also ask if there are any referral requirements for accessing specialized care.

- Restrictions or requirements: Retirees should investigate if the new plan imposes any restrictions or requirements that could hinder timely access to medical services. They should specifically ask about prior authorizations or pre-visit confirmations, as these may introduce additional steps before receiving certain treatments or services.

- Out-of-pocket expenses: It is important to inquire about the out-of-pocket expenses associated with the new plan, including deductibles, copayments, and prescription drug costs. Retirees should understand the potential financial implications and compare them to their current healthcare plan.

- Cost comparison: Retirees should inquire about how the cost of the new plan compares to their previous healthcare plan. They should ask if there are any projected increases in premiums or other costs, and if so, how significant those increases might be.

- Coverage for necessary medical services: Retirees should ensure that the new plan covers all the necessary medical services and treatments they currently require. It is important to review the plan’s coverage details, paying attention to any potential limitations or exclusions.

- Specific benefits or additional services: Inquire about any specific benefits or additional services offered under the new plan that may improve the retirees’ healthcare experience. Examples could include preventive care programs, wellness initiatives, or expanded coverage for certain treatments or therapies.

- Support and resources: Retirees should seek information about the support and resources available to assist them in understanding and navigating the new plan. This could include access to informational materials, helplines, or counseling services to address questions or concerns that may arise during the transition.

- Alternative options: Ask if there are any alternative options, such as the “Option C” proposed by the retirees, that could maintain premium-free senior care while also achieving cost savings for the city. Understanding the feasibility and potential benefits of alternative options is crucial in making an informed decision.

- Recourse and avenues for grievances: Retirees should inquire about the recourse available to them if they are dissatisfied with the new plan. They should ask about avenues for appeal or addressing grievances, ensuring that there are processes in place to handle complaints and provide resolution.

NYC Retirees Fight for Medicare

In a city known for its bustling streets and towering skyscrapers, a group of retired New York City workers is making waves in their fight for the right to Medicare. The NYC Retirees Association (NYCRA) has emerged as a staunch advocate for the healthcare needs of retired municipal workers, tirelessly working to protect the rights and benefits they rightfully deserve. With a commitment to ensuring access to quality healthcare, the NYCRA has become a driving force in advocating for Medicare coverage for NYC retirees.

A Voice for Retirees: The NYCRA, founded by retired civil servants, serves as a collective voice for the retirees, bringing attention to their unique healthcare challenges. As retirees transition from active service to their golden years, the NYCRA recognizes the importance of providing them with affordable and comprehensive healthcare options promised to them by the City of New York. Their mission centers around securing Medicare coverage as a viable solution for retirees, guaranteeing them the medical care they need and deserve.

Fighting for the Right to Medicare: At the heart of the NYCRA’s mission is the belief that Medicare is a fundamental right for all retired NYC workers. They argue that these individuals have dedicated their lives to serving the city and should be granted access to affordable healthcare without undue financial burdens. The NYCRA firmly believes that Medicare provides a robust and reliable healthcare system that caters to the unique needs of retirees, offering peace of mind and ensuring their well-being.

Championing Retiree Concerns: The NYCRA actively addresses the concerns raised by retirees regarding healthcare coverage. They advocate for policies that prioritize retirees’ access to doctors and specialists, ensuring that they can continue receiving care from trusted healthcare providers. By engaging in discussions with relevant authorities and representatives, the NYCRA works to bridge the gap between retirees and decision-makers, amplifying their concerns and pushing for favorable outcomes.

Collaboration and Support: Recognizing the power of collaboration, the NYCRA works closely with other organizations, retiree groups, and influential figures to strengthen their advocacy efforts. By building alliances and fostering partnerships, they increase their influence and collective bargaining power. The NYCRA also provides a platform for retirees to connect with one another, offering support, resources, and guidance in navigating the complexities of the healthcare system.

Raising Awareness and Mobilizing Change: The NYCRA understands that change starts with raising awareness. They actively engage in public outreach, leveraging traditional and digital media platforms to spread their message far and wide. Through informational campaigns, town hall meetings, and community events, they educate retirees and the general public about the importance of Medicare coverage and the impact it has on retired NYC workers.

The Road Ahead: While the fight for Medicare coverage for NYC retirees continues, the NYCRA remains steadfast in their commitment to this critical cause. They will continue to advocate for retirees’ rights, engage in meaningful dialogue with decision-makers, and seek avenues for change. The NYCRA’s unwavering determination ensures that the voices of retired municipal workers will be heard and that their healthcare needs will be met.

The NYC Retirees Association stands as a beacon of hope for retired NYC workers in their pursuit of Medicare coverage. With a united front and unwavering dedication, they champion the rights of retirees, amplifying their concerns and advocating for access to affordable and comprehensive healthcare. Through their tireless efforts, the NYCRA is paving the way for a future where retired municipal workers can enjoy their retirement years with the peace of mind that comes from having quality healthcare coverage.

Disclaimer: The content in this article is provided for general informational purposes only. It may not be accurate, complete, or up-to-date and should not be relied upon as legal, financial, or other professional advice. Any actions or decisions taken based on this information are the sole responsibility of the user. Medicare-365 and/or BL Monahan Inc expressly disclaims any liability for any loss, damage, or harm that may result from reliance on this information. Please note that this article may contain affiliate endorsements and advertisements. The inclusion of such does not indicate an endorsement or approval of the products or services linked. Medicare-365 and/or BL Monahan Inc does not accept responsibility for the content, accuracy, or opinions expressed on any linked website. When you engage with these links and decide to make a purchase, we may receive a percentage of the sale. This affiliate commission does not influence the price you pay, and we disclaim any responsibility for the products or services you purchase through these links.