Let’s talk about a great option for your healthcare needs: Reliance Medicare Advantage, based in Farmington Hills, Michigan. They offer Medicare Advantage plans, also known as Medicare Part C, which go beyond what Original Medicare provides by adding extra benefits and services.

I’ve found that these plans can really make a difference. You can explore options like dental, vision, and hearing coverage, wellness programs, and prescription drug coverage. When you’re ready, their licensed sales agents are there to help you understand all these options and find what fits you best.

I know details like coverage areas, costs, and provider networks can sometimes be confusing. That’s why I recommend reaching out to Reliance directly. They’ll give you all the comprehensive information you need to make the best decision for your situation.

Overview of Reliance Medicare Advantage

Reliance Medicare Advantage, headquartered in Farmington Hills, Michigan, provides Medicare Advantage plans, also known as Medicare Part C. These private health plans work with the federal government to offer an alternative to Original Medicare, often including additional benefits and services not covered by traditional Medicare.

With Reliance, you can get a range of services like dental, vision, and hearing coverage, wellness programs, and prescription drug coverage. Their Medicare Advantage plans are designed to offer more comprehensive care options, aiming to enhance your overall healthcare experience. These plans are especially beneficial if you’re looking for more extensive coverage than what Original Medicare alone offers.

Reliance connects you with licensed sales agents who provide personalized assistance in selecting the most suitable plan for your healthcare needs. While they offer a variety of plans, details about coverage areas, costs, and provider networks aren’t always readily available. You should always contact an agent first to find out details about their plans and availability in your state.

Location and Contact Information

If you’re considering a Medicare Advantage plan, Reliance Medicare Advantage, based in Farmington Hills, Michigan, is here to help. For any inquiries or assistance, you can contact Reliance Medicare Advantage directly. Just give them a call at (248) 482-2393.

This contact line connects you with licensed sales agents who can provide detailed information about the various Medicare Advantage plans available, including the additional benefits and services that go beyond Original Medicare.

Their office is conveniently located in Farmington Hills, MI 48336, and operates during standard business hours. Don’t hesitate to reach out and get the comprehensive information you need to make the best choice for your healthcare needs.

Extra Benefits and Sales Agents

Reliance Medicare Advantage plans come with a variety of extra benefits that go beyond what Original Medicare offers. These additional benefits often include dental, vision, and hearing coverage—services that traditional Medicare plans typically don’t cover.

Wellness programs are another fantastic feature, promoting preventive care and healthy living among members. Plus, their prescription drug coverage ensures you have access to necessary medications, often at lower costs.

To help you navigate these options, Reliance Medicare Advantage connects you with licensed sales agents. These agents provide personalized assistance, making it easier for you to understand the various plan options and choose the one that best meets your healthcare needs.

The sales agents are well-versed in the specifics of each plan, including the extra benefits offered. They can provide you with detailed information, ensuring you make informed decisions about your healthcare.

Missing Coverage and Costs Details

Reliance Medicare Advantage offers a variety of Medicare Advantage plans; however, specific details about coverage areas, costs, and provider networks are not readily available.

This lack of detailed information can make it challenging for you to fully understand the scope and financial implications of the plans.

For instance, while these plans include valuable benefits like dental, vision, and hearing coverage, as well as wellness programs and prescription drug coverage. The exact costs associated with these benefits aren’t specified in the available resources.

Since understanding these details is crucial, I encourage you to contact Reliance Medicare Advantage directly to get comprehensive information about the plans.

Licensed sales agents are ready to provide personalized assistance, helping you explore the various options and understand the specific details of coverage and costs.

By reaching out directly, you’ll gain a clear understanding of the financial commitments and coverage specifics, ensuring you can make informed decisions about your healthcare needs.

Service Areas and Coverage

Reliance Medicare Advantage plans are available in specific service areas, and the coverage can vary significantly depending on your location.

For example, the Reliance Dual Care Plus (HMO D-SNP) plan in Michigan offers comprehensive benefits, including $0 copays for primary and specialist doctor visits, diagnostic procedures, and emergency care.

This plan also covers routine eye exams, eyeglasses, and contact lenses at no additional cost to you.

The availability of these plans and the specific benefits they offer can differ by region. In some areas, you might find plans with $0 monthly premiums for both health and drug plans, while others might require you to pay the Medicare Part B premium and include an annual deductible for drug plans.

To get detailed information about the service areas and specific coverage options available in your region, you should contact Reliance Medicare Advantage directly.

This direct contact is crucial for understanding the exact benefits, costs, and provider networks associated with the plans in your area.

State-Specific Coverage Options

Reliance Medicare Advantage plans offer state-specific coverage options that can vary significantly based on your location. For example, in Michigan, the Reliance Dual Care Plus (HMO D-SNP) plan provides comprehensive benefits, including $0 copays for primary and specialist doctor visits, diagnostic procedures, and emergency care.

This plan also covers routine eye exams, eyeglasses, and contact lenses at no additional cost to you. The availability and specifics of these plans can differ by state and even within regions of a state.

In some areas, you might find plans with $0 monthly premiums for both health and drug plans, while other areas might require you to pay the Medicare Part B premium and include an annual deductible for drug plans.

Additionally, the network of doctors and hospitals, as well as the out-of-pocket costs, can vary depending on the state and the specific plan you choose.

To get detailed information about the state-specific coverage options available to you, I encourage you to contact Reliance Medicare Advantage directly. This direct contact is essential for understanding the exact benefits, costs, and provider networks associated with the plans in your area, ensuring you can make informed decisions about your healthcare needs.

State-Specific Enrollment Periods

State-specific enrollment periods for Medicare Advantage plans, including those offered by Reliance Medicare Advantage, are designed to accommodate various life events and circumstances. These periods allow you to enroll in, switch, or make changes to your Medicare Advantage plans outside the standard enrollment windows. Here are the key state-specific enrollment periods:

- Initial Enrollment Period (IEP): This is a 7-month period that begins 3 months before the month you turn 65, includes your birth month, and ends 3 months after your birth month. If you qualify due to disability, the IEP starts 3 months before the 25th month of receiving disability benefits and ends 3 months after the 25th month.

- General Enrollment Period (GEP): Occurs annually from January 1 through March 31. If you didn’t sign up for Medicare Part A and/or Part B during your IEP, you can enroll during this period, with coverage starting on July 1 of the same year.

- Special Enrollment Periods (SEPs): These are triggered by specific life events and allow you to make changes to your Medicare Advantage plans outside the standard enrollment periods. Some common SEPs include:

- Moving: If you move to a new address outside your current plan’s service area, you can switch to a new plan that serves your new location. This SEP lasts for 2 months after the move.

- Losing Other Coverage: If you lose other health coverage, such as employer or union coverage, you have 2 months to enroll in a Medicare Advantage plan.

- Qualifying for Extra Help: If you qualify for Extra Help with Medicare prescription drug costs, you can join, switch, or drop a Medicare Advantage Plan with drug coverage at any time.

- 5-Star Special Enrollment Period: If a 5-star Medicare Advantage Plan is available in your area, you can switch to this plan once between December 8 and November 30 of the following year.

- Chronic Conditions: If you have a severe or disabling condition and there is a Medicare Chronic Care Special Needs Plan (SNP) available that serves people with your condition, you can join this plan at any time.

- Medicare Advantage Open Enrollment Period (MA OEP): From January 1 to March 31 each year, you can switch to another Medicare Advantage Plan or return to Original Medicare with or without a Part D plan.

- Fall Open Enrollment: Occurs annually from October 15 to December 7. During this period, you can change the way you receive your Medicare coverage, including switching between Medicare Advantage and Original Medicare, or changing Medicare Advantage plans.

These enrollment periods ensure you have multiple opportunities to adjust your Medicare Advantage coverage based on your changing needs and circumstances. For specific details about state-specific enrollment periods and eligibility, you should contact Reliance Medicare Advantage directly.

State-Specific Eligibility Criteria

State-specific eligibility criteria for Medicare Advantage plans, including those offered by Reliance Medicare Advantage, generally align with federal guidelines but may have unique provisions based on state regulations.

General Eligibility Criteria

To be eligible for Medicare Advantage plans, you must meet the following criteria:

- Be enrolled in both Medicare Part A and Part B.

- Reside in the plan’s service area.

- Be a U.S. citizen or lawfully present in the U.S.

Age and Disability

Most people become eligible for Medicare at age 65. However, younger individuals may qualify if they have a disability, End-Stage Renal Disease (ESRD), or Amyotrophic Lateral Sclerosis (ALS).

State-Specific Provisions

Some states may have additional eligibility criteria or offer special programs to assist with Medicare costs. For example, if you are a low-income senior or an adult with disabilities, you may qualify for Medicare Savings Programs (MSPs), which help pay for Medicare premiums, deductibles, coinsurance, and copayments. These programs are essential for making healthcare more affordable.

Enrollment Periods

State-specific enrollment periods generally follow federal guidelines but may include additional Special Enrollment Periods (SEPs) based on state-specific circumstances. For instance, if you lose other health coverage or move to a new service area, you may qualify for an SEP.

Coordination with Other Insurance

If you have other health insurance coverage, such as through an employer or a spouse’s employer, it is crucial to understand how these benefits coordinate with Medicare. This coordination ensures that your healthcare expenses are appropriately covered by the primary and secondary insurance plans, avoiding duplication of coverage or payment.

Financial Assistance Programs

States may offer additional financial assistance programs to help with Medicare costs. These programs can vary significantly by state and may include assistance with premiums, deductibles, and other out-of-pocket expenses.

Special Needs Plans (SNPs)

Some states offer Special Needs Plans (SNPs) tailored to individuals with specific conditions or circumstances, such as chronic illnesses or dual eligibility for Medicare and Medicaid. These plans provide additional benefits and services tailored to the needs of their members.

Contacting Reliance Medicare Advantage

To understand the specific eligibility criteria and enrollment periods applicable in your state, you should contact Reliance Medicare Advantage directly. This direct contact is essential for making informed decisions about your healthcare coverage and ensuring compliance with state-specific regulations.

State-Specific Plan Customizations

State-specific plan customizations are essential for ensuring that estate plans are tailored to meet the unique legal requirements and benefits available in each state. These customizations can significantly impact the effectiveness of an estate plan, particularly in areas such as tax liabilities, probate processes, and trust administration.

Estate Tax Planning

Estate and inheritance tax laws vary widely from state to state. For example, New York imposes an estate tax rate of up to 16% on estates valued over $6.94 million, whereas Florida and 32 other states impose no estate tax at all. This stark contrast necessitates a tailored approach to minimize tax liabilities and ensure more assets pass to chosen beneficiaries. Leveraging state-specific tax benefits, such as incentives for certain types of assets or charitable donations, can further optimize an estate plan.

Probate and Trust Administration

The probate process can be complex and time-consuming, with significant variations in requirements across states. Efficient estate settlement involves navigating these state-specific probate requirements to ensure a seamless transfer of assets to heirs and beneficiaries. Trust administration also requires adherence to unique state laws and regulations, managing trusts with precision to oversee asset distribution, handle creditor claims, and ensure compliance with trust terms.

Out-of-State Property Management

Managing property across state lines adds another layer of complexity to estate planning. It is crucial to structure the estate plan to comply with the laws of each state involved, ensuring seamless management and distribution of assets. This often involves coordinating with legal experts in multiple jurisdictions to address the specific requirements of each state.

Legal Expertise Beyond California

While the focus may be on California’s unique estate planning laws, expertise in multistate estate planning is also vital. This includes understanding the specific jurisdictional laws and developing strategies that account for these differences to create a comprehensive and effective estate plan.

Customization of Trusts

Customizing trusts to address changing times and life circumstances is crucial for a resilient, long-lasting estate plan. This includes drafting trust dispositive terms that adjust based on current estate and generation-skipping tax laws and incorporating flexible provisions to anticipate potential changes. Strategies such as distributions for health, education, maintenance, and support (HEMS), step-ups on the basis of trust assets, powers of appointment, and the use of a Trust Protector can provide significant benefits and adaptability.

Special Needs Trusts

Adding a special needs trust to any estate plan can protect trust assets if a beneficiary is collecting government benefits due to a disability or additional needs. This ensures that the beneficiary’s eligibility for government assistance is not compromised while still providing for their needs through the trust. By providing detailed family and financial information to the attorney, the estate plan can be closely tailored to meet specific needs and goals, ensuring compliance with state-specific laws and maximizing the benefits available under those laws.

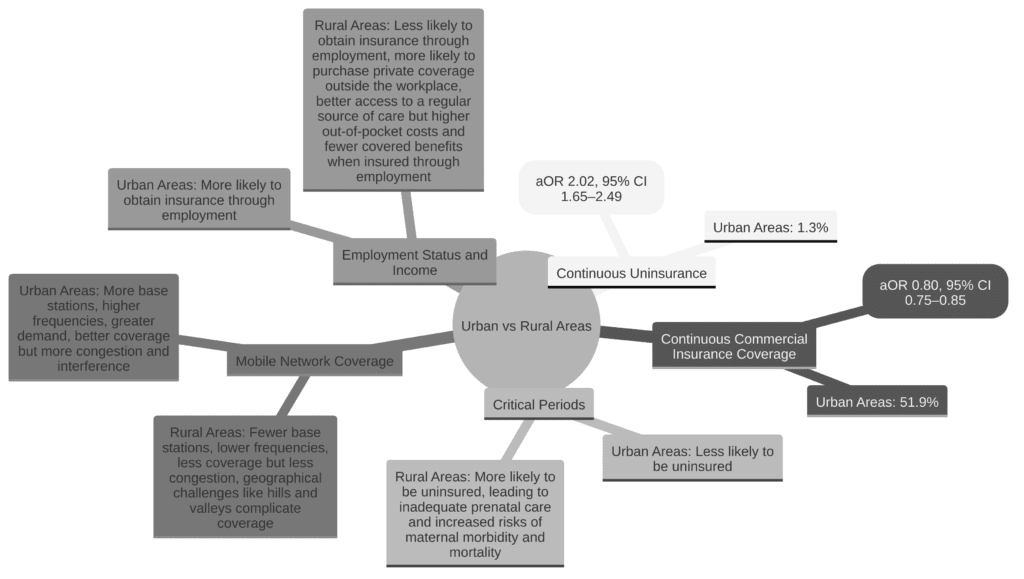

Urban vs. Rural Coverage

Urban and rural areas exhibit significant differences in health insurance coverage and access to care.

| Aspect | Urban Areas | Rural Areas |

| Continuous Uninsurance | 1.3% | 2.7% (aOR 2.02, 95% CI 1.65–2.49) |

| Continuous Commercial Insurance Coverage | 51.9% | 40.2% (aOR 0.80, 95% CI 0.75–0.85) |

| Critical Periods (Prepregnancy, Birth, Postpartum) | Less likely to be uninsured | More likely to be uninsured, leading to inadequate prenatal care and increased risks of maternal morbidity and mortality |

| Mobile Network Coverage | More base stations, higher frequencies, greater demand, better coverage but more congestion and interference | Fewer base stations, lower frequencies, less coverage but less congestion, geographical challenges like hills and valleys complicate coverage |

| Employment Status and Income | More likely to obtain insurance through employment | Less likely to obtain insurance through employment, more likely to purchase private coverage outside the workplace, better access to a regular source of care but higher out-of-pocket costs and fewer covered benefits when insured through employment |

Health insurance coverage in rural areas is also affected by employment status and income. Rural residents are less likely to obtain insurance through employment and more likely to purchase private coverage outside the workplace.

Despite these challenges, uninsured rural residents may have better access to a regular source of care compared to their urban counterparts, although they face higher out-of-pocket costs and fewer covered benefits when insured through employment.

Overall, the disparities in health insurance coverage and access to care between urban and rural areas highlight the need for targeted policy interventions to address these inequities and improve healthcare outcomes for rural populations.

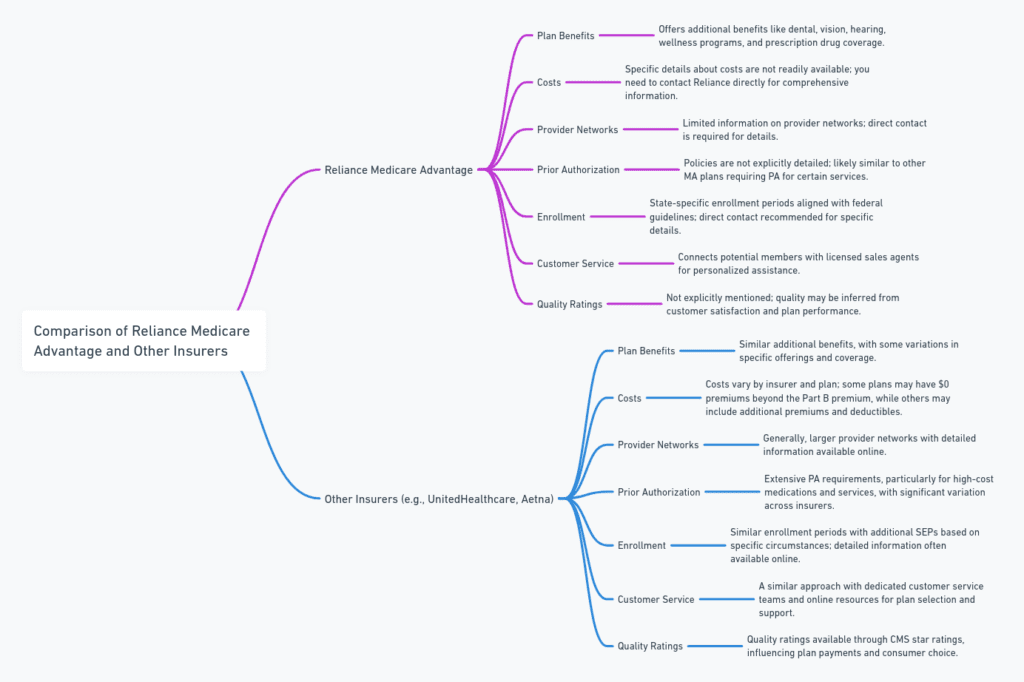

Comparing Reliance Medicare Advantage to Other Insurers

When comparing Reliance Medicare Advantage to other insurers, it’s essential to examine various aspects such as plan benefits, costs, and coverage policies. The following table summarizes key differences and similarities:

| Aspect | Reliance Medicare Advantage | Other Insurers (e.g., UnitedHealthcare, Aetna) |

| Plan Benefits | Offers additional benefits like dental, vision, hearing, wellness programs, and prescription drug coverage. | Similar additional benefits, with some variations in specific offerings and coverage. |

| Costs | Specific details about costs are not readily available; you need to contact Reliance directly for comprehensive information. | Costs vary by insurer and plan; some plans may have $0 premiums beyond the Part B premium, while others may include additional premiums and deductibles. |

| Provider Networks | Limited information on provider networks; direct contact is required for details. | Generally, larger provider networks with detailed information available online. |

| Prior Authorization | Policies are not explicitly detailed; likely similar to other MA plans requiring PA for certain services. | Extensive PA requirements, particularly for high-cost medications and services, with significant variation across insurers. |

| Enrollment | State-specific enrollment periods aligned with federal guidelines; direct contact recommended for specific details. | Similar enrollment periods with additional SEPs based on specific circumstances; detailed information often available online. |

| Customer Service | Connects potential members with licensed sales agents for personalized assistance. | A similar approach with dedicated customer service teams and online resources for plan selection and support. |

| Quality Ratings | Not explicitly mentioned; quality may be inferred from customer satisfaction and plan performance. | Quality ratings available through CMS star ratings, influencing plan payments and consumer choice. |

Reliance Medicare Advantage plans are designed to offer comprehensive care options, similar to other major insurers, but with less readily available detailed information on costs and provider networks.

You are encouraged to contact Reliance directly to obtain specific details and personalized assistance from licensed sales agents.

Other insurers, such as UnitedHealthcare, often provide extensive online resources and larger provider networks, making it easier for you to compare plans and make informed decisions.

Network Hospitals and Clinics

Network hospitals and clinics are healthcare facilities that have agreements with specific health insurance companies to provide medical services to policyholders at negotiated rates. These partnerships offer several advantages:

Benefits of Network Hospitals

- Cashless Treatment: One of the most significant benefits is the cashless treatment facility. You can receive medical care without having to pay upfront for services covered by your insurance. Instead, the insurance company directly settles the bills with the hospital, provided the treatment falls within the policy’s coverage limits.

- Negotiated Rates: Insurance companies negotiate treatment and stay costs with network hospitals to prevent their expenses from spiraling. This arrangement helps reduce the overall cost of medical care for policyholders, making healthcare more affordable.

- Streamlined Claims Process: The claims process is generally more straightforward and faster at network hospitals. Since these hospitals are familiar with the insurance company’s procedures and requirements, they can facilitate quicker claim settlements, enhancing your satisfaction.

- Quality Assurance: Insurers typically partner with hospitals that meet specific quality criteria, ensuring reliable care for policyholders. This partnership often results in better healthcare outcomes and higher patient satisfaction.

Disadvantages of Non-Network Hospitals

- Out-of-Pocket Expenses: At non-network hospitals, you must pay for medical services out of pocket and then seek reimbursement from your insurance company. This process can be time-consuming and cumbersome, involving extensive documentation and longer waiting periods for claim settlements.

- Higher Costs: Non-network hospitals may charge higher rates for medical services compared to network hospitals. This can lead to increased out-of-pocket expenses, making healthcare less affordable.

- Complex Claims Process: The claims process at non-network hospitals is often more complex and time-consuming. You need to collect and submit all necessary documents to the insurance company, which then reviews and processes the claim according to the policy terms and conditions.

Role of Third-Party Administrators (TPAs)

Third-party administrators (TPAs) play a crucial role in managing the relationship between insurance companies, policyholders, and network hospitals. Their responsibilities typically include member enrollment, issuance of health cards, pre-authorization for cashless treatment, and reimbursement claim processing. TPAs help streamline the claims process, ensuring you receive timely and efficient service.

Finding Network Hospitals

You can find a list of network hospitals through your insurance provider’s website or app. In emergencies, contacting the insurer’s customer support can provide immediate information about nearby network hospitals. Having this information readily available is crucial for quick access to medical care during emergencies.

Exceptions and Special Cases

In certain emergency situations where network hospitals are not accessible, insurance companies might treat a non-network hospital visit as in-network. You should inform your insurer as soon as possible and provide the necessary documentation to facilitate this exception.

Overall, opting for network hospitals offers significant advantages in terms of cost savings, convenience, and quality of care. Familiarize yourself with the list of network hospitals associated with your insurance plan to maximize these benefits.

Medicare Advantage Card Benefits

The Reliance Medicare Advantage card is an essential tool for members enrolled in Reliance Medicare Advantage plans. This card provides access to a range of healthcare services and benefits, facilitating seamless interactions with healthcare providers and pharmacies.

Key Features of the Reliance Medicare Advantage Card

- Identification and Verification: The card contains essential information such as your name, identification number, and plan details. Healthcare providers use this information to verify your eligibility and coverage, ensuring you receive the appropriate services under your plan.

- Access to Network Providers: Use the card to access a network of doctors, hospitals, and other healthcare providers that have agreements with Reliance Medicare Advantage. This network ensures you receive care at negotiated rates, often resulting in lower out-of-pocket costs.

- Prescription Drug Coverage: Present the card at pharmacies to access your prescription drug benefits. This ensures you receive covered medications at the plan’s negotiated prices, which can include lower copays and discounts.

- Emergency and Urgent Care: In emergencies or urgent care situations, the card provides critical information that healthcare providers can use to quickly verify coverage and provide necessary treatment. This feature is crucial for ensuring timely and appropriate care during medical emergencies.

- Additional Benefits: Use the card to access additional benefits offered by Reliance Medicare Advantage plans, such as dental, vision, and hearing services. Present the card to participating providers to receive these services as part of your plan benefits.

Using the Card

- At Healthcare Providers: Present your Reliance Medicare Advantage card at each visit to a healthcare provider. This ensures the provider can verify coverage and bill the insurance company directly for covered services.

- At Pharmacies: When filling prescriptions, present your card to the pharmacist to access your prescription drug benefits. This helps in applying the plan’s coverage and any applicable discounts or copays.

- For Additional Services: For services such as dental, vision, or hearing care, present your card to the participating providers to ensure these services are covered under your plan.

Replacement and Assistance

If you lose your Reliance Medicare Advantage card or need a replacement, contact Reliance Medicare Advantage customer service for assistance. The customer service team can issue a new card and provide the necessary support to ensure continuous access to healthcare services.

Provider Service Contact Number

For healthcare providers needing to contact Reliance Medicare Advantage, the primary provider service phone number is (248) 482-2393. This line connects providers with the necessary support and information regarding Reliance Medicare Advantage plans, including details about coverage, claims, and network participation.

Providers can also reach out to Reliance Medicare Advantage for assistance with technical issues related to secure pages and online tools by calling (888) 850-8526. For urgent matters outside regular business hours, providers can contact the after-hours and holiday support line at (866) 322-6287. This ensures that providers have access to necessary support at all times, facilitating continuous and efficient patient care.

FAQs

Q: What types of Medicare Advantage plans does Reliance Medicare Advantage offer?

A: Reliance Medicare Advantage offers a variety of Medicare Advantage plans, including Health Maintenance Organization (HMO) plans and Special Needs Plans (SNPs). These plans often include additional benefits such as dental, vision, and hearing coverage, wellness programs, and prescription drug coverage.

Q: How can I find out if my doctor is in the Reliance Medicare Advantage network?

A: To determine if your doctor is in the Reliance Medicare Advantage network, you can contact Reliance Medicare Advantage directly or visit their website to access the provider directory. This directory lists all the doctors, hospitals, and other healthcare providers that are part of the network.

Q: Are there any additional costs associated with the extra benefits offered by Reliance Medicare Advantage plans?

A: While Reliance Medicare Advantage plans include extra benefits such as dental, vision, and hearing coverage, the specific costs associated with these benefits can vary. You should contact Reliance Medicare Advantage directly to obtain detailed information about any additional costs or copays related to these benefits.

Q: What should I do if I need emergency care while traveling outside my plan’s service area?

A: If you need emergency care while traveling outside your plan’s service area, seek immediate medical attention. Reliance Medicare Advantage plans typically cover emergency care services regardless of where you are. Be sure to present your Reliance Medicare Advantage card to the healthcare provider to facilitate coverage verification and billing.

Q: How do I enroll in a Reliance Medicare Advantage plan?

A: To enroll in a Reliance Medicare Advantage plan, contact Reliance Medicare Advantage directly to speak with a licensed sales agent who can guide you through the enrollment process. You can also visit their website to find more information about the enrollment periods and the necessary steps to join a plan.

Q: Can I switch from my current Medicare Advantage plan to a Reliance Medicare Advantage plan?

A: Yes, you can switch from your current Medicare Advantage plan to a Reliance Medicare Advantage plan during the Annual Enrollment Period (AEP) or a Special Enrollment Period (SEP) if you qualify. Contact Reliance Medicare Advantage for assistance with the process and to understand the specific requirements for switching plans.

Q: What is the maximum out-of-pocket limit for Reliance Medicare Advantage plans?

A: The maximum out-of-pocket limit for Reliance Medicare Advantage plans can vary depending on the specific plan. This limit is the maximum amount you will have to pay for covered services in a year. For detailed information about the out-of-pocket limits for specific plans, contact Reliance Medicare Advantage directly.

Q: Are there any wellness programs included in Reliance Medicare Advantage plans?

A: Yes, Reliance Medicare Advantage plans often include wellness programs designed to promote preventive care and healthy living. These programs may include fitness memberships, health education, and other wellness initiatives. Contact Reliance Medicare Advantage for more details about the wellness programs available with their plans.

Final Thought

When it comes to choosing the right Medicare plan, personalized assistance can make all the difference. Reliance is dedicated to helping you find the most suitable plan for your needs. Since the availability and specifics of these plans can vary by state, it’s essential to get in touch with Reliance directly for detailed information about coverage areas, costs, and provider networks.

I hope this overview has given you a clear understanding of what Reliance Medicare Advantage plans offer and how they function across different states. For further details and personalized assistance, please reach out to Reliance Medicare Advantage directly. They are there to help you every step of the way, ensuring you have all the information needed to make the best choice for your healthcare needs.