I. Introduction

Hello there! If you’ve been navigating the Medicare world, you’ve probably stumbled upon terms like “AEP” and “OEP.” And you might be wondering, “What’s the difference between Medicare AEP and OEP?” Well, you’re in the right place! Think of this as your friendly guide to understanding these two periods. We’ll break it down, keep it simple, and by the end, you’ll have a clear picture of what each one means to you. Let’s dive in!

II. Medicare Annual Enrollment Period (AEP)

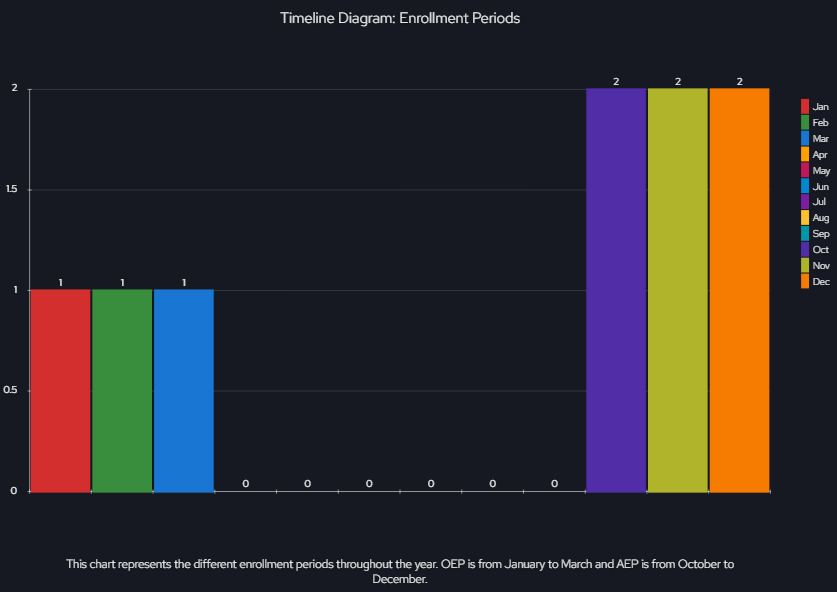

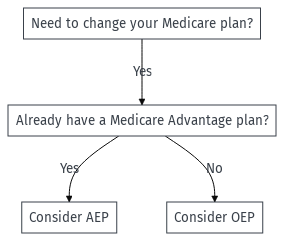

Ever heard of the “Annual Enrollment Period” or AEP? Think of it as a shopping season but for Medicare plans! From October 15th to December 7th, you get to take a good look at your current plan. If you want, you can make some changes. Maybe you want a different plan, or perhaps you want to add something extra. Whatever you decide, the new stuff kicks in on January 1st.

What Changes Can You Make During AEP?

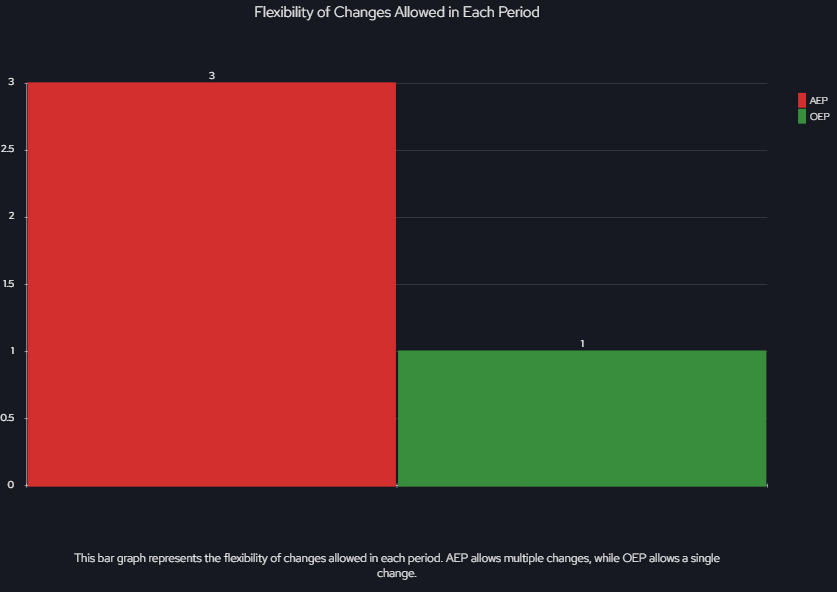

The flexibility offered during the AEP is extensive, allowing beneficiaries to:

- Switch from Original Medicare (Part A and Part B) to a Medicare Advantage Plan (Part C).

- Move from a Medicare Advantage Plan back to Original Medicare.

- Transition between different Medicare Advantage Plans.

- Enroll in a Medicare Part D prescription drug plan for the first time or switch from one Medicare Part D plan to another.

- Opt to drop Medicare Part D prescription drug coverage completely.

It’s worth noting that any changes made during the AEP will become effective on January 1st of the following year, ensuring a seamless transition for beneficiaries.

Timeline for AEP

Marking your calendar is crucial. As mentioned, the AEP begins on October 15th and concludes on December 7th. While this provides a reasonable timeframe for beneficiaries to make decisions, it’s advisable not to wait until the last minute. Reviewing plan options, consulting with healthcare providers, and possibly seeking advice from Medicare experts can take time. Early preparation can lead to more informed choices, ensuring that you select the plan that best aligns with your health needs and financial situation.

Visual Guide: Timeline and Flexibility

III. Medicare Open Enrollment Period (OEP)

Unpacking OEP: What It Entails

The Medicare Open Enrollment Period, or OEP for short, happens every year from January 1st to March 31st. Think of it as a special time when folks who already have a Medicare Advantage plan can make some changes if they want to.

What Can You Do During the Medicare Open Enrollment Period?

During OEP, here’s what you can do:

- If you have a Medicare Advantage Plan but want a different one, you can switch.

- If you’re thinking, “I miss my old Original Medicare,” you can go back to it.

- And, if you go back to Original Medicare, you can also pick a drug plan, which is called Part D.

But, here’s what you can’t do during OEP:

- If you have the regular, old-fashioned Medicare (we call it Original Medicare), you can’t switch to a Medicare Advantage Plan.

- You also can’t join or switch drug plans (Part D) if you’re on Original Medicare.

How Many Changes Can You Make During OEP?

Now, this is important: You get just one chance to make a change during OEP. It’s like having one ticket to use. So, think carefully, talk to family or friends, and make sure you’re happy with the change you choose.

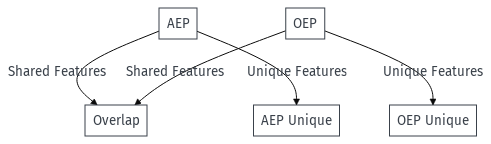

IV. AEP vs. OEP: What’s the Difference?

Understanding the Two Times of the Year

Okay, let’s break this down simply. There are two main times in the year when you can make changes to your Medicare plans: AEP and OEP. These might sound like just letters, but they’re important periods to remember.

AEP: The Big Shopping Time

AEP stands for the Annual Enrollment Period. Think of it like a big shopping season for Medicare. It happens every year from October 15th to December 7th. During AEP, you can:

- Change from regular Medicare to a special kind called Medicare Advantage.

- Go back from Medicare Advantage to regular Medicare.

- Pick or change a drug plan.

- And even drop a drug plan if you don’t want it anymore.

OEP: The Fine-Tuning Time

Next comes OEP, which is short for Open Enrollment Period. This one’s from January 1st to March 31st. It’s a bit different from AEP. During OEP, you can:

- Switch to a different Medicare Advantage plan if you want.

- Or, go back to your old, regular Medicare.

But there’s one thing to remember: you only get one chance to make a change during OEP. So, think it over and choose wisely.

Which One’s for Me?

If you’re thinking about making lots of changes or exploring different plans, AEP might be your time. But if you’re just looking to make one important change, then OEP is when you’d do it.

Breaking Down the Differences with Visuals

Venn Diagram highlighting the similarities and differences between AEP and OEP

V. Medicare Advantage Open Enrollment Period (MA OEP)

What’s MA OEP?

MA OEP is just a short way to talk about the Medicare Advantage Open Enrollment Period. It’s a special time that happens every year from January 1st to March 31st. This time is mostly for folks who already have a special kind of Medicare called Medicare Advantage.

What Can I Do During This Time?

During MA OEP, you have a couple of choices:

- If you have a Medicare Advantage plan but think a different one might be better, you can switch to that other plan.

- If you’re thinking, “I liked my old Medicare better,” you can go back to the regular Medicare.

But, and this is important, you can only make ONE of these changes. It’s like getting one special ticket for a change, so be sure about what you want.

What Can’t I Do?

There are a few things you can’t do during MA OEP:

- If you have the old-fashioned, regular Medicare, this time isn’t for making changes.

- You can’t switch to a Medicare Advantage plan from regular Medicare.

- And, you can’t hop around between different drug plans if you’re on regular Medicare.

Why Is This Important for Me?

Sometimes, what seemed like a good choice last year might not feel right this year. Our health needs or how we feel about our plan can change. That’s why MA OEP is here. It’s like a safety net, letting you make a change if you need to.

V. Oops, Missed the Enrollment Time?

We get it; dates can slip by! But missing out on these enrollment times can be a bit of a pickle. If you miss out, you might be stuck with your current plan for a whole year. And nobody likes unwanted surprises! Sometimes, though, life throws us curveballs, like moving to a new place. If that happens, there’s a special time called the “Special Enrollment Period” where you can make some changes.

To guide beneficiaries on which enrollment period to consider based on their current plan and needs.

VI. What if Things Change?

Life Can Be Full of Surprises

We all know life can be unpredictable. Maybe you moved to a new town, or perhaps your health needs have shifted a bit since last year. These changes can make you wonder about your Medicare plan.

The Special Enrollment Period: A Little Help When Needed

There’s good news! If big changes happen in your life outside of the usual enrollment times, there’s a thing called the “Special Enrollment Period” or SEP. This is like a bonus time that lets you make changes to your Medicare if certain events happen in your life.

What Counts as a Big Change?

Here are some examples of life events that could give you an SEP:

- Moving to a new address that’s not in your plan’s service area.

- Losing your current insurance, maybe because you’re no longer working.

- Living in, or moving out of, a care facility like a nursing home.

What Should I Do If I Have a Big Change?

If something big happens:

- Check if it qualifies you for an SEP.

- If it does, you’ll have a chance to review and change your Medicare plan to better fit your new situation.

Remember, it’s always okay to ask for help. If you’re unsure about anything, it might be a good idea to chat with someone who knows about Medicare. They can guide you on the best steps to take.

VII. Tips for a Smooth Medicare Ride

- Research: Before any big decision, do a little homework. Understand what each plan offers.

- Ask for Help: If things get too messy, chat with an expert. They’re there to help!

- Review Your Plan: Every year, give your plan a quick check. Your needs might change!

- Stay Updated: Plans can change. Keep an eye out for any letters or updates about your plan.

- Think Ahead: Health is a long game. Think about what you might need in the future.

VIII. Wrapping Up

As we grow older, having good health coverage becomes even more important. Medicare is like a trusted friend, offering a helping hand when we need medical care. It might seem a bit confusing with all these terms like AEP, OEP, and SEP. But once you take a little time to understand, it becomes much clearer.

Remember, every year, you have the chance to look at your plan and decide if it’s still the right fit. And if life throws a curveball, Medicare has ways to help you adjust, like the Special Enrollment Period.

So, take a deep breath, think about what’s best for you, and always know that you have choices. After all, you’ve spent a lifetime earning these benefits. They’re here to make sure you’re taken care of.

FAQs:

1. What is the duration of the Medicare AEP?

- Medicare AEP runs annually from October 15th to December 7th.

2. When will the changes made during AEP be effective?

- Any modifications made during AEP will come into effect on January 1st of the following year.

3. Is it mandatory to change my Medicare plan during AEP?

- No, there is no compulsion to alter your Medicare plans during AEP. However, given that plan details might vary yearly, it’s recommended to review your plan each AEP to ensure it remains suitable.

4. Can I opt-out of Medicare Part D during AEP?

- Yes, during AEP, beneficiaries have the choice to discontinue their Medicare Part D coverage.

5. Do I always have to change my Medicare plan every year?

- No, you don’t have to. But it’s a good idea to look at your plan each year to see if it still fits your needs.

6. What’s the difference between AEP and OEP again?

- AEP is like a shopping time for Medicare plans from October 15th to December 7th. OEP, from January 1st to March 31st, is more for folks who want to make a single change to their Medicare Advantage plan.

7. Can I switch to a different drug plan during OEP?

- Only if you’re switching from a Medicare Advantage plan back to Original Medicare. Otherwise, OEP isn’t the time for changing drug plans.

8. I moved to a new state. Can I change my plan outside of AEP or OEP?

- Yes! Moving to a new place is one of those big life changes that can give you a Special Enrollment Period (SEP) to adjust your plan.

9. I’m feeling a bit lost. Where can I get help?

- It’s okay to ask for help. There are Medicare experts and helplines you can call. They can answer your questions and guide you. Call us 1-844-552-7426 or book a meeting