The difference between plan g and Plan Medigap Plan G and Plan N are two popular Medigap plans that provide additional coverage to Original Medicare (Medicare Part A and Part B). Here are the key differences between the two:

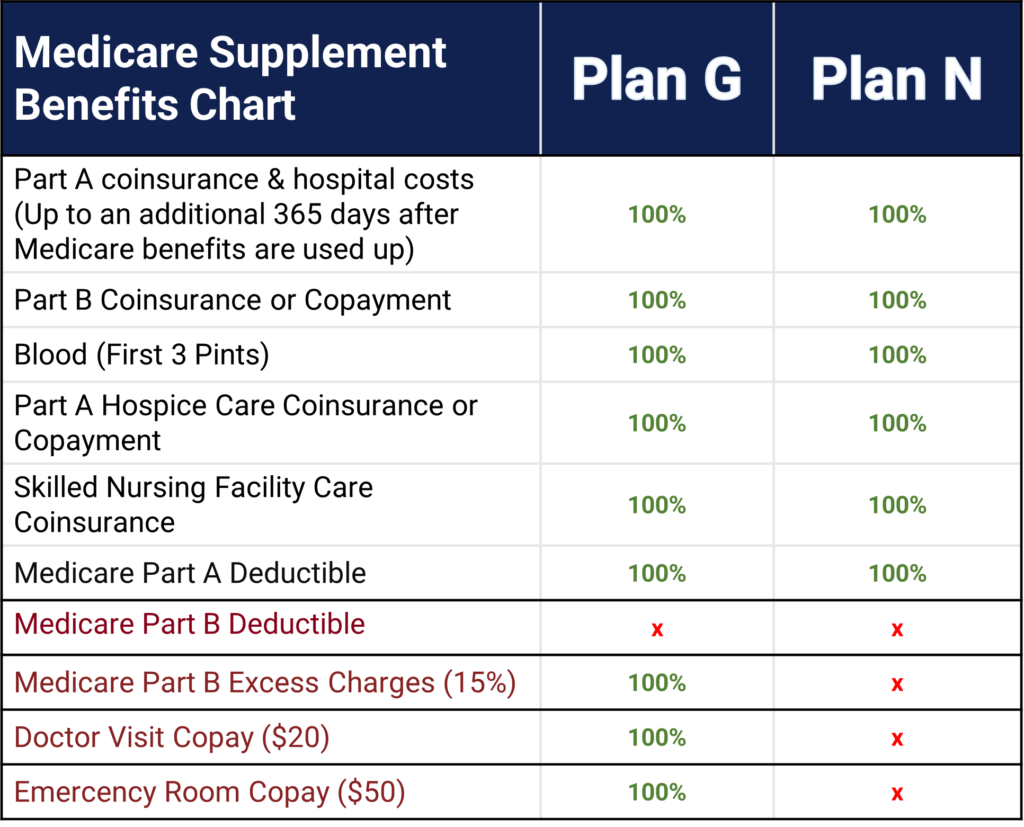

- Coverage: Both Plan G and Plan N offer similar basic benefits, including coverage for Medicare Part A coinsurance and hospital costs, Medicare Part B coinsurance or copayments, and the first three pints of blood. However, there are some differences in coverage:

- Plan G covers the Medicare Part B deductible, which is the out-of-pocket amount you pay for medical services before Medicare starts covering its share. Plan N does not cover the Part B deductible.

- Plan G covers excess charges, which are additional charges that some healthcare providers may impose on top of the Medicare-approved amount. Plan N does not cover excess charges.

- Plan N requires a copayment of up to $20 for office visits and up to $50 for emergency room visits that do not result in an inpatient admission.

- Premiums: Plan G generally has higher premiums compared to Plan N. However, the difference in premiums can vary depending on factors such as your location, insurance provider, age, and health status. It’s important to compare quotes from different insurance companies to get an accurate idea of the costs.

- Out-of-pocket costs: With Plan G, you generally have fewer out-of-pocket costs compared to Plan N. Plan G covers the Part B deductible and excess charges, which can result in lower costs when you receive medical services. Plan N requires copayments for certain services, such as office visits and emergency room visits.

Ultimately, the right choice between Plan G and Plan N depends on your individual healthcare needs, budget, and preferences. It’s important to evaluate your expected medical expenses, compare plan costs, and consider any specific coverage requirements you may have before making a decision. Additionally, it can be helpful to consult with a licensed insurance agent who specializes in Medicare to get personalized advice based on your situation.

When it comes to selecting a Medicare supplement insurance plan, Medigap Plan N and Plan G are two popular options worth considering. While both plans offer additional coverage to Original Medicare, they have distinct differences that can greatly impact your healthcare expenses and overall satisfaction. In this article, we will delve into the details of Medigap Plan N and Plan G, enabling you to make an informed decision about which plan is best suited for your needs.

Medicare supplement Plan N is often hailed as the best value among all the Medigap plans. It provides a comprehensive set of benefits while maintaining a reasonable premium cost. Plan N covers the majority of expenses associated with Medicare Part A, including hospital costs and coinsurance. It also covers Part B coinsurance or copayments, with the exception of a copayment of up to $20 for office visits and up to $50 for emergency room visits that do not result in an inpatient admission. However, one aspect where Plan N differs from Plan G is that it does not cover the Part B deductible, which is an out-of-pocket expense for beneficiaries. Additionally, Plan N does not cover excess charges, which are additional costs that some healthcare providers may charge beyond the Medicare-approved amount.

On the other hand, Medigap Plan G is often referred to as the “Peace of Mind” Medicare supplement plan due to its extensive coverage. Plan G is highly regarded for offering the most benefits among all the Medigap plans available to new Medicare beneficiaries. It covers all the expenses included in Plan N, with the added advantage of covering the Part B deductible. This means that with Plan G, you won’t have to pay the out-of-pocket amount before Medicare begins its coverage. Furthermore, Plan G covers excess charges, which can be beneficial if you frequently receive care from healthcare providers who impose these additional fees.

One key factor to consider when choosing between Plan N and Plan G is the cost. Generally, Plan G has higher premiums compared to Plan N. However, the difference in premiums can vary depending on factors such as your location, insurance provider, age, and health status. It’s crucial to carefully evaluate the premiums associated with each plan and compare them against your anticipated medical expenses. Additionally, consider your personal preferences and priorities when it comes to healthcare coverage and out-of-pocket costs.

Ultimately, the decision between Medigap Plan N and Plan G should be based on your individual healthcare needs and financial circumstances. If you prioritize cost-effectiveness while still enjoying comprehensive coverage, Plan N might be the right choice for you. However, if you value the peace of mind that comes with having a higher level of coverage, including the Part B deductible and excess charges, Plan G might be the better option.

To make an informed decision, it’s advisable to compare quotes from different insurance providers, consult with a licensed insurance agent specializing in Medicare, and carefully assess your expected medical expenses. Remember that your choice of Medigap plan can have a significant impact on your healthcare costs and overall satisfaction, so take the time to evaluate your options thoroughly.