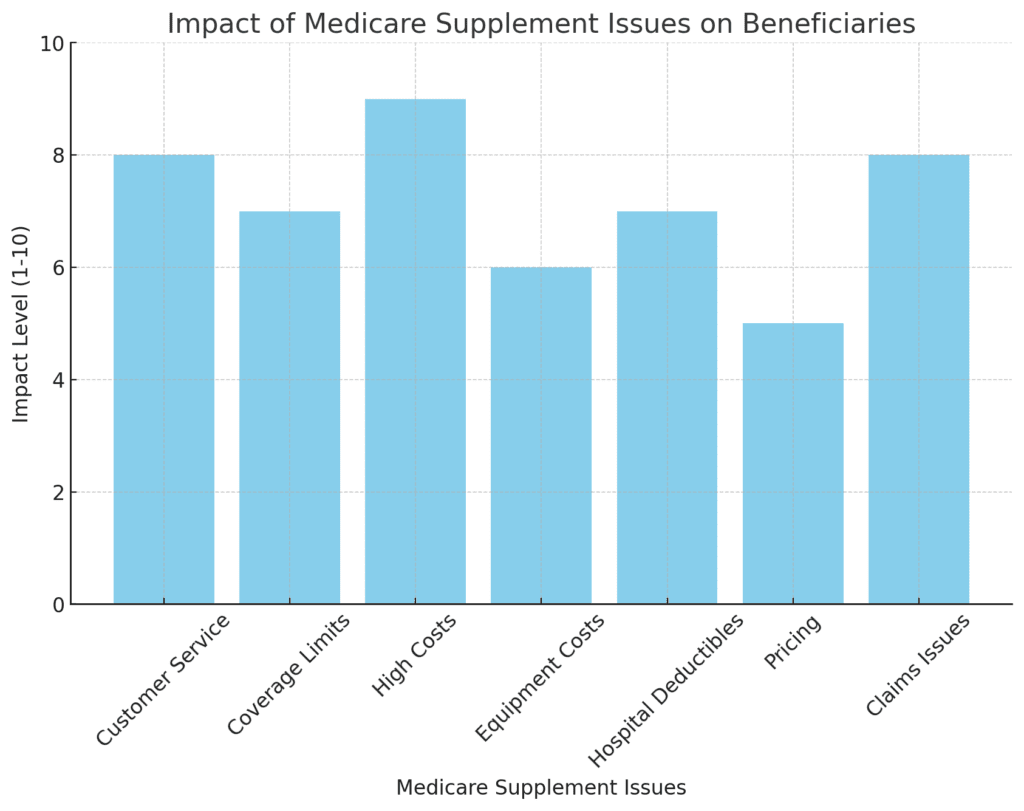

The world of Medicare Supplement Insurance, commonly known as Medigap, can be a minefield for unsuspecting beneficiaries. In 2023, while many companies offer valuable services, others fall short in critical areas. This article uncovers the troubling realities behind some of the worst Medicare supplement companies, shedding light on issues that often go unnoticed.

Key Takeaways Table

| Key Issues | Description | Impact on Beneficiaries |

|---|---|---|

| Customer Service Issues | Inadequate support and guidance, leading to confusion and frustration. | Increased stress and potential for incorrect decision-making. |

| Limited Coverage & Provider Choice | Restrictions on healthcare providers and specialized services. | Limited access to necessary care and treatments. |

| High Out-of-Pocket Costs | Elevated expenses for specific treatments under some plans. | Financial burden and potential forgoing of essential healthcare. |

| Medical Equipment & Drug CostsSignificant cost-sharing for medical equipment and drugs. | Additional financial strain for essential health items. | |

| Hospital Admission DeductiblesHigher deductibles than Original Medicare for inpatient visits. | Unexpected and increased hospitalization costs. | |

| Misleading PricingLower coverage plans costing more than comprehensive ones. | Overpayment for less coverage, impacting financial resources. | |

| Claims Payouts & Appeals | Challenges in claim approvals and denial of legitimate claims. | Stressful appeals process and potential lack of coverage when needed. |

1. Prevalent Customer Service Issues

Poor customer service stands out as a significant problem among the worst Medicare supplement companies. Beneficiaries frequently encounter unhelpful, unresponsive, or even misleading customer service representatives. This can lead to a lack of support and guidance, leaving beneficiaries confused and frustrated. Issues can range from long wait times on calls to receiving incorrect or incomplete information about coverage and benefits.

Example: A Medicare beneficiary reported difficulties in obtaining clear information about plan benefits, experiencing prolonged wait times and inconsistent responses from customer service agents.

Read More – Medigap.com

2. Restrictive Coverage and Provider Choices

Some of the worst Medicare supplement companies limit the choice of healthcare providers and specialized services. This restriction can hinder beneficiaries from accessing the care they need. Additionally, these plans may require preauthorization for specific treatments, further complicating access to healthcare.

Example: A patient needed a specialized treatment that was not covered by their Medicare supplement plan, leading to substantial out-of-pocket expenses and delayed care.

Learn More – Medigap.com

3. High Out-of-Pocket Expenses for Specific Treatments

High out-of-pocket costs for particular treatments are another significant concern. Some plans require beneficiaries to pay much higher expenses than traditional Medicare, especially for specific treatments or services. This can make essential healthcare unaffordable for many.

Case Study: A beneficiary with a chronic condition faced unexpectedly high out-of-pocket costs for their regular treatment under their Medicare supplement plan.

Discover More – Medigap.com

4. Expensive Medical Equipment and Drug Costs

Medical equipment and drug costs under these plans can be exorbitantly high. For instance, durable medical equipment like wheelchairs or CPAP machines often comes with a significant cost share. Similarly, drugs administered in a doctor’s office, such as chemotherapy, can incur high expenses.

Real-Life Example: A beneficiary required a mobility device and had to pay 20% of the cost, which amounted to a substantial sum, under their Medicare Advantage plan.

Find Out More – Medigap.com

5. Issues with Hospital Admission Deductibles

Hospital admission deductibles under some Medicare supplement plans can be more expensive than those under Original Medicare. This can lead to high costs for beneficiaries during inpatient visits.

Scenario: A patient admitted to the hospital was surprised to find that their Medicare supplement plan required a higher deductible than anticipated, significantly increasing their overall hospital costs.

More Information – Medigap.com

6. Misleading Pricing Structures

Pricing structures for different Medicare supplement plans can be misleading. In some cases, plans with lower coverage may cost more than those offering comprehensive coverage. This discrepancy can lead to beneficiaries overpaying for less coverage.

Illustration: A comparison of Plan A and Plan G from a major insurance provider showed that Plan A, with more basic benefits, was priced higher than the more comprehensive Plan G.

Explore Further – Honolulu Star-Advertiser

7. Problems with Claims Payouts and Appeals

Finally, issues with claims payouts and the appeals process are prevalent among the worst Medicare supplement companies. Beneficiaries often face challenges in getting their claims approved, with companies sometimes denying claims on questionable grounds.

Incident: A policyholder’s legitimate claim for a critical health condition was denied, leading to a prolonged and stressful appeals process.

Read More About This Issue – ConsumerAffairs®

Conclusion

Navigating Medicare Supplement Insurance can be challenging, especially with the presence of companies that fail to meet beneficiaries’ needs adequately. The issues highlighted in this article, from poor customer service to misleading pricing structures and problems with claims payouts, underscore the importance of careful research and consideration when choosing a Medicare supplement plan. Beneficiaries must stay informed and vigilant to avoid falling prey to these pitfalls and ensure they receive the coverage and care they deserve.