If you’re nearing retirement or are already retired, you’ve likely heard about the Income-Related Monthly Adjustment Amount (IRMAA). IRMAA is a provision of Medicare that affects your Medicare premiums and prescription drug costs. It’s important to understand how IRMAA works, how it affects your Medicare cost, and what you can do to plan for it effectively.

In this article, we’ll discuss the basics of IRMAA, including how it affects your Medicare Part B and Part D costs. We’ll also look at how IRMAA impacts your retirement income, your Social Security benefits, and your Medicare enrollment. Finally, we’ll discuss the tax implications of IRMAA and how to reduce your tax liability.

What Is IRMAA?

IRMAA is a provision of Medicare that requires higher-income beneficiaries to pay higher premiums for Medicare Part B and Part D. The purpose of IRMAA is to ensure that wealthier individuals pay a larger share of their healthcare costs. IRMAA is based on your income from two years ago, and it’s adjusted annually for inflation.

How Does IRMAA Affect Your Medicare Part B Costs?

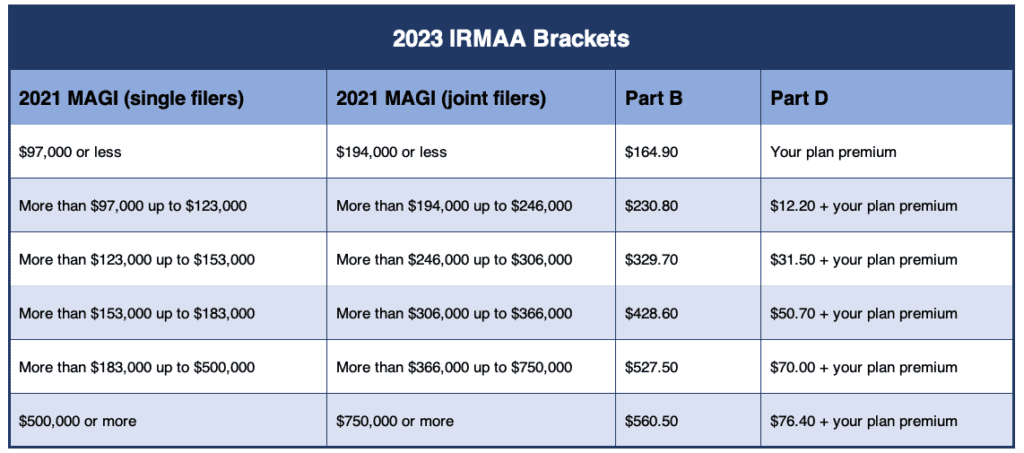

Medicare Part B covers doctor visits, outpatient care, and medical equipment. The standard monthly premium for Medicare Part B in 2023 is $170.10. However, if your income is above a certain threshold, you’ll have to pay a higher premium due to IRMAA.

The IRMAA premium is calculated based on your modified adjusted gross income (MAGI) from two years ago. For 2023, the income threshold for IRMAA is $91,000 for individuals and $182,000 for couples filing jointly. If your MAGI is above these thresholds, you’ll pay an additional amount on top of the standard Part B premium. The higher your income, the higher your IRMAA premium.

How Does IRMAA Affect Your Medicare Part D Costs?

Medicare Part D is the prescription drug coverage portion of Medicare. Like Medicare Part B, the standard monthly premium for Medicare Part D in 2023 is $38.80. However, if your income is above a certain threshold, you’ll pay a higher premium due to IRMAA.

The IRMAA premium for Medicare Part D is also calculated based on your MAGI from two years ago. For 2023, the income threshold for IRMAA is the same as for Medicare Part B: $91,000 for individuals and $182,000 for couples filing jointly. If your MAGI is above these thresholds, you’ll pay an additional amount on top of the standard Part D premium.

How Does IRMAA Affect Your Retirement Income?

IRMAA can significantly impact your retirement income, especially if you’re a high-earner. If you’re subject to IRMAA, you’ll pay higher premiums for both Medicare Part B and Part D, which can add up to thousands of dollars per year.

To plan for IRMAA, it’s important to include it in your retirement income projections. You’ll want to factor in the higher premiums when determining your retirement budget and income needs. Additionally, you may want to consider strategies to reduce your income in retirement, such as delaying Social Security benefits or using tax-advantaged accounts.

How Does IRMAA Affect Your Social Security Benefits?

IRMAA can also impact your Social Security benefits. If you’re subject to IRMAA, you’ll pay higher premiums for Medicare Part B, which are deducted from your Social Security benefits. This means that your Social Security checks will be smaller if you’re subject to IRMAA.

How Does IRMAA Affect Your Social Security Benefits?

To reduce the impact of IRMAA on your Social Security benefits, you can request a reconsideration of your IRMAA decision. If your income has decreased since the two-year period used to calculate your IRMAA premium, you may be eligible for a lower premium. You can also request a waiver of IRMAA if you experienced a life-changing event, such as the death of a spouse, divorce, or retirement.

How Do You Request a Reconsideration or Waiver of IRMAA?

To request a reconsideration of your IRMAA decision, you’ll need to complete and submit Form SSA-44 to the Social Security Administration (SSA). The SSA will review your request and notify you of their decision.

To request a waiver of IRMAA, you’ll need to complete and submit Form SSA-632-BK to the SSA. You’ll need to provide documentation of your life-changing event, such as a death certificate or divorce decree.

How Do IRMAA Income Limits Work?

The income thresholds for IRMAA are based on your MAGI from two years ago. MAGI includes your adjusted gross income plus any tax-exempt interest income. If your income for the current year is expected to be significantly lower than your MAGI from two years ago, you may be able to request a lower IRMAA premium. This is known as a “life-changing event” and includes situations such as retirement, the death of a spouse, or divorce.

How Does IRMAA Affect Your Medicare Enrollment?

If you’re subject to IRMAA, you may also face penalties if you don’t enroll in Medicare at the appropriate time. You’ll want to make sure you enroll in Medicare Part B and Part D during your initial enrollment period to avoid penalties.

How Does IRMAA Affect Your Medicare Advantage Costs?

IRMAA does not directly affect your Medicare Advantage costs, but it can impact your ability to enroll in a Medicare Advantage plan. To enroll in a Medicare Advantage plan, you must first be enrolled in both Medicare Part A and Part B. If you’re subject to IRMAA, you may face higher premiums for Medicare Part B, which can make it more difficult to afford a Medicare Advantage plan.

What Are the Tax Implications of IRMAA Medicare Premiums?

IRMAA Medicare premiums are considered part of your medical expenses for tax purposes. If you itemize your deductions, you can deduct your medical expenses that exceed 7.5% of your adjusted gross income (AGI). However, if you’re subject to IRMAA, your AGI will be higher, which means you may not be able to deduct as much of your medical expenses.

To reduce the tax implications of IRMAA, you can use tax-advantaged accounts, such as a Health Savings Account (HSA) or a Flexible Spending Account (FSA), to pay for your out-of-pocket healthcare costs.

IRMAA is an important provision of Medicare that can significantly impact your retirement income and healthcare costs. It’s important to understand how IRMAA works, how it affects your Medicare premiums and prescription drug costs, and what you can do to plan for it effectively. By taking proactive steps, such as requesting reconsideration or waiver of IRMAA, staying within income limits, and using tax-advantaged accounts, you can reduce the impact of IRMAA on your retirement income and enjoy a more secure retirement.

- Loss of pension income

- Certain types of settlements or judgments

To request an LCE, you’ll need to fill out a form and provide proof of the event, such as a death certificate or a letter from your employer. If approved, the SSA will adjust your IRMAA based on your more recent income.

FAQs:

Q: Can I avoid IRMAA by not reporting my income?

A: No, if you don’t report your income, you risk penalties and loss of benefits. The SSA will also use other sources to verify your income, such as the IRS and the Social Security database.

Q: Does IRMAA apply to all Medicare beneficiaries?

A: No, IRMAA only applies to Medicare Part B and Part D enrollees with higher incomes. Most beneficiaries don’t pay IRMAA.

Q: Can I appeal my IRMAA determination?

A: Yes, you can request an appeal if you think the SSA made an error in calculating your IRMAA or if you have a qualifying LCE. You must file your appeal within 60 days of receiving your determination notice.

Q: Do IRMAA thresholds change every year?

A: Yes, the IRMAA income thresholds are adjusted annually based on inflation.

IRMAA is an additional cost that some Medicare beneficiaries must pay if their income exceeds certain thresholds. It’s important to understand how IRMAA is calculated and how it affects your Medicare costs. If you experience a life-changing event that affects your income, you may be able to request a new determination and lower your IRMAA. Keep in mind that IRMAA is separate from late enrollment penalties and other Medicare costs, so it’s important to plan for all your healthcare expenses. We hope this article has answered your FAQs on IRMAA and helped you make informed decisions about your Medicare coverage.

Pingback: The Basics of Medicare Coverage | Medicare365

Pingback: Medicare & Group Health Insurance | Medicare365