Who is this guide for?

Pharmacy Tiers 101. If you’re enrolled in a Part D prescription drug plan or considering enrolling, this guide is for you. Understanding how drug tiers work is essential for managing your prescription drug costs and making informed decisions about your healthcare.

Understanding Pharmacy Tiers

Prescription drugs can be expensive, and understanding how they are categorized can help you make informed decisions about your healthcare. Pharmacy tiers are the way in which prescription drugs are grouped by their cost and coverage. Most Part D prescription drug plans have different drug tiers, which group medications by their cost and coverage. These tiers are used to determine how much you’ll need to pay for your prescription drugs, and they can vary depending on your plan.

Importance of Pharmacy Tiers

Managing your prescription drug costs is essential, especially if you’re enrolled in a Part D prescription drug plan. Understanding how drug tiers work can help you identify which drugs are covered by your plan, what tier they’re in, and how much you’ll need to pay for them. This knowledge can help you make informed decisions about your healthcare and save money on your prescription drug costs.

For example, let’s say you need medication for a chronic condition, and you find out that it’s in a higher tier with a higher copay. By understanding pharmacy tiers, you may be able to work with your doctor to find an alternative medication that’s in a lower tier, which can save you money in the long run.

Additionally, knowing which drugs are covered in each tier can help you plan your healthcare expenses and budget accordingly. You can also compare prices at different pharmacies to find the best deal and potentially save even more money on your prescription drug costs.

Overall, understanding pharmacy tiers is an essential aspect of managing your prescription drug costs and making informed decisions about your healthcare. By staying informed and working with your doctor and plan provider, you can navigate the complexities of drug tiers and find the most affordable options for your healthcare needs.

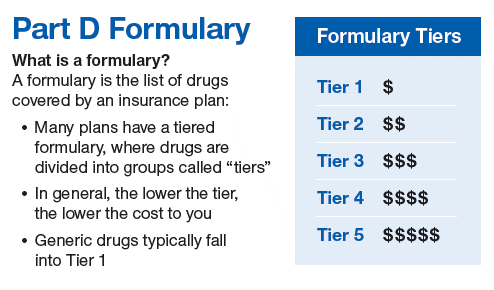

The first step to understanding pharmacy tiers is to know what they are. Pharmacy tiers are the way in which prescription drugs are grouped by their cost and coverage. Each tier has a different copay or coinsurance amount, with lower tiers having lower costs and higher tiers having higher costs. Tier 1 drugs are usually the most affordable and offer the greatest coverage, while Tier 5 drugs are the most expensive and have the least amount of coverage.

Knowing which drugs are covered in each tier is essential for managing your prescription drug costs. By using your plan’s formulary or drug list, you can easily find out what tier your drugs are in and how much you’ll need to pay for them. This information can help you plan your healthcare expenses and budget accordingly.

For example, let’s say you need medication for a chronic condition. If you don’t know what tier it’s in, you could end up paying more than you need to. By understanding pharmacy tiers and knowing what tier your medication is in, you can work with your doctor and plan provider to find the most affordable options for your healthcare needs.

In addition to helping you save money on your prescription drug costs, understanding pharmacy tiers can also help you make informed decisions about your healthcare. By knowing which drugs are covered in each tier, you can compare different treatment options and choose the one that’s best for you.

Overall, understanding pharmacy tiers is crucial to managing your prescription drug costs and making informed decisions about your healthcare. By staying informed and working with your doctor and plan provider, you can navigate the complexities of drug tiers and find the most affordable options for your healthcare needs.

Tiered Formulary Explained

The tiered formulary is a crucial aspect of understanding pharmacy tiers. This is because the formulary determines which drugs are included in each tier and how much you’ll need to pay for them. Your plan’s formulary is a list of prescription drugs that are covered by your plan and grouped into different tiers based on their cost and coverage.

When you enroll in a Part D prescription drug plan, you’ll receive a copy of your plan’s formulary. This formulary will show you which drugs are covered by your plan, what tier they’re in, and how much you’ll need to pay for them. The formulary can be updated throughout the year, so it’s important to check for changes periodically.

A tiered formulary is an essential tool for managing your prescription drug costs. By knowing which drugs are covered in each tier, you can plan your healthcare expenses and budget accordingly. You can also work with your doctor and plan provider to find the most affordable options for your healthcare needs.

For example, let’s say you need medication for a chronic condition. If you don’t know what tier it’s in, you could end up paying more than you need to. By checking your plan’s formulary, you can easily find out what tier your medication is in and how much you’ll need to pay for it.

It’s important to note that the tiered formulary can vary depending on your plan. While most Part D prescription drug plans follow a similar structure, there may be differences in the drugs that are included in each tier and the costs associated with each tier. That’s why it’s important to review your plan’s formulary regularly and to reach out to your plan’s customer service department if you have any questions or concerns.

Overall, the tiered formulary is an essential tool for managing your prescription drug costs and making informed decisions about your healthcare. By staying informed and working with your doctor and plan provider, you can navigate the complexities of drug tiers and find the most affordable options for your healthcare needs.

How Prescription Drugs are Categorized in Tiers

Understanding how prescription drugs are categorized in tiers is essential for managing your healthcare costs. Most Part D prescription drug plans have five tiers, each with its own copay or coinsurance amount.

Tier 1 includes preferred generic drugs, which are usually the most affordable and offer the greatest coverage. These drugs are often the first-line treatment for many common conditions.

Tier 2 includes generic drugs, which are also more affordable than brand-name drugs. Generic drugs are similar to their brand-name counterparts, but they are usually less expensive because they don’t have the same research and development costs.

Tier 3 includes preferred brand-name drugs, which are often more expensive than generic drugs but offer greater coverage. These drugs are usually newer or more specialized than generic drugs and may be recommended by your doctor for specific conditions.

Tier 4 includes non-preferred brand-name drugs, which are even more expensive than preferred brand-name drugs. These drugs may have a higher copay or coinsurance amount, and they may be recommended by your doctor if other treatments have not been effective.

Tier 5 includes specialty drugs, which are often the most expensive and have the least amount of coverage. These drugs are usually used to treat rare or complex conditions and may require special administration or monitoring.

It’s important to note that the drugs in each tier can vary depending on your plan. Some plans may have more or fewer tiers, or they may have different copay or coinsurance amounts for each tier. That’s why it’s important to review your plan’s formulary and understand which drugs are covered in each tier.

By understanding how prescription drugs are categorized into tiers, you can work with your doctor and plan provider to find the most affordable treatment options for your healthcare needs. You can also compare prices at different pharmacies to find the best deal and potentially save even more money on your prescription drug costs.

Pharmacy Tiers and Medicare Advantage

Medicare Advantage plans are an alternative to Original Medicare, and they often include prescription drug coverage. These plans are offered by private insurance companies that have been approved by Medicare. They can provide a range of benefits beyond what Original Medicare offers, such as vision, dental, and hearing coverage.

Many Medicare Advantage plans also include prescription drug coverage, also known as Part D coverage. These plans can have different pharmacy tiers, just like standalone Part D plans. It’s important to understand how pharmacy tiers work with Medicare Advantage in order to choose the best plan for your healthcare needs.

When you enroll in a Medicare Advantage plan with Part D coverage, you’ll receive a copy of the plan’s formulary. This formulary will show you which drugs are covered by the plan, what tier they’re in, and how much you’ll need to pay for them. It’s important to review this formulary and understand the costs associated with each tier.

It’s also important to note that not all Medicare Advantage plans offer the same pharmacy tiers. Some plans may have more or fewer tiers, or they may have different copay or coinsurance amounts for each tier. That’s why it’s important to compare plans and review their formularies to find the one that’s best for you.

Choosing a Medicare Advantage plan with the right pharmacy tiers can help you save money on your prescription drug costs. By understanding the costs associated with each tier and choosing a plan that offers the most affordable options for your healthcare needs, you can reduce your out-of-pocket expenses and manage your healthcare costs more effectively.

Overall, understanding how pharmacy tiers work with Medicare Advantage is an essential aspect of managing your prescription drug costs and making informed decisions about your healthcare. By staying informed and working with your plan provider, you can navigate the complexities of drug tiers and find the most affordable options for your healthcare needs.

How Pharmacy Tiers Work with Medicare Advantage

Medicare Advantage plans to use the same tiered formulary system as Part D prescription drug plans. This means that the drugs included in each tier and the associated copays or coinsurance amounts will be similar to those of standalone Part D plans.

However, some Medicare Advantage plans may have different tiers or offer additional drug coverage options. For example, some plans may offer lower copays for drugs in certain tiers or may offer additional coverage for drugs not included in the standard formulary.

It’s important to review the formulary for each Medicare Advantage plan you’re considering to understand how its pharmacy tiers work. Look for any differences in the tier structure or costs associated with each tier. This will help you make an informed decision about which plan is best for your healthcare needs and budget.

It’s also important to consider any additional drug coverage options offered by Medicare Advantage plans. Some plans may offer coverage for drugs not included in the standard formulary or may offer special programs to help you manage the cost of your prescription drugs. Be sure to review all of the plan’s drug coverage options and take advantage of any programs or services that can help you save money on your prescription drug costs.

Choosing the right Medicare Advantage plan with the right pharmacy tiers can help you save money on your prescription drug costs and manage your healthcare expenses more effectively. By staying informed and working with your plan provider, you can navigate the complexities of drug tiers and find the most affordable options for your healthcare needs.

Benefits of Choosing a Plan with Pharmacy Tiers

Choosing a Medicare Advantage plan with pharmacy tiers can offer several benefits for managing your healthcare costs.

Firstly, it can help you save money on your prescription drug costs. By understanding which drugs are covered in each tier and how much you’ll need to pay for them, you can make informed decisions about which drugs to use and potentially avoid costly medications. For example, you may be able to switch to a lower-tier drug that is just as effective but has a lower copay or coinsurance amount.

Additionally, choosing a plan with pharmacy tiers can help you budget for your healthcare expenses. By knowing the costs associated with each tier, you can plan ahead and avoid unexpected expenses. This can be particularly helpful for individuals on a fixed income or those with limited healthcare resources.

Furthermore, choosing a plan with pharmacy tiers can help you make informed decisions about your healthcare. By understanding the tiered formulary system and which drugs are included in each tier, you can work with your doctor to find the most effective and affordable treatment options for your healthcare needs.

Finally, choosing a plan with pharmacy tiers can give you peace of mind. You’ll know that you have coverage for the drugs you need and that you’re not paying more than you need to for your prescription medications.

Overall, choosing a Medicare Advantage plan with pharmacy tiers can offer several benefits for managing your healthcare costs and making informed decisions about your healthcare. By understanding the tiered formulary system and reviewing the formulary for each plan you’re considering, you can find the most affordable and effective options for your healthcare needs.

Understanding Co-Pays and Deductibles

The cost of prescription drugs can vary depending on the pharmacy tier they’re in and your plan’s copays and deductibles. Understanding how co-pays and deductibles work is essential for managing your healthcare costs.

Co-pays are fixed amounts that you pay for each prescription. For example, if you have a $10 co-pay for a Tier 1 drug, you’ll pay $10 for each prescription of that drug. Co-pays can vary depending on the pharmacy tier and your plan’s coverage. Generally, drugs in lower tiers have lower co-pays than drugs in higher tiers.

Deductibles, on the other hand, are the amount you need to pay before your plan starts covering your prescription drug costs. For example, if you have a $500 deductible and you’ve only paid $100 towards it, you’ll need to pay the remaining $400 before your plan starts covering your prescription drug costs. Deductibles can also vary depending on your plan and the pharmacy tier.

It’s important to review your plan’s copays and deductibles to understand the costs associated with each pharmacy tier. This can help you budget for your healthcare expenses and avoid unexpected costs.

Additionally, it’s important to review the formulary for each plan you’re considering to understand which drugs are included in each tier and the associated costs. You can also compare prices at different pharmacies to find the best deal.

By understanding co-pays and deductibles and reviewing your plan’s formulary, you can make informed decisions about your healthcare and manage your prescription drug costs more effectively.

How Tier Placement Affects Costs

The placement of your prescription drug in a tier can significantly impact your out-of-pocket costs. The cost of a prescription drug can vary depending on the tier it’s placed in. Drugs in lower tiers generally have lower copays or coinsurance, while drugs in higher tiers have higher costs.

For example, Tier 1 drugs are usually the most affordable and offer the greatest coverage, while Tier 5 drugs are the most expensive and have the least amount of coverage. This means that if you’re prescribed a drug in Tier 5, you may be responsible for paying a larger portion of the cost.

It’s important to review your plan’s formulary to understand which drugs are included in each tier and the associated costs. This can help you budget for your healthcare expenses and avoid unexpected costs. Additionally, you can talk to your doctor about whether there are alternative drugs available that are in a lower tier and may be more affordable.

By understanding how tier placement affects costs, you can make informed decisions about your healthcare and manage your prescription drug costs more effectively. It’s important to review your plan’s formulary, compare prices at different pharmacies, and talk to your doctor about cost-effective options. This can help you find the most affordable and effective treatment options for your healthcare needs.

Strategies to Save Money on Prescription Drugs

Managing your prescription drug costs can be challenging, but there are several strategies you can use to save money and make healthcare more affordable. Here are some strategies to consider:

- Use generic drugs: Generic drugs are often less expensive than brand-name drugs and are just as effective. Ask your doctor if a generic drug is available for your prescription.

- Compare prices at different pharmacies: Prices for the same prescription drug can vary significantly between different pharmacies. Compare prices at different pharmacies to find the best deal.

- Use mail-order pharmacy services: Mail-order pharmacy services can be a convenient and cost-effective option for getting your prescription drugs. These services can offer discounts and often provide free delivery.

- Ask about prescription drug assistance programs: Many pharmaceutical companies offer assistance programs for individuals who can’t afford their prescription drugs. Ask your doctor or pharmacist if there are any programs available for the drugs you need.

- Check for drug discount coupons: Drug discount coupons can be found online or through your plan provider. These coupons can help you save money on your prescription drugs.

- Consider pill-splitting: Pill-splitting involves cutting a higher-dose pill in half to create two doses. This can be a cost-effective option for some prescription drugs.

By using these strategies and working with your plan provider, you can save money on your prescription drug costs and make healthcare more affordable. It’s important to review your plan’s formulary, talk to your doctor about cost-effective options, and take advantage of any programs or services that can help you save money on your prescription drugs.

V. Brand-Name Drugs and Phar

Availability of Brand-Name Drugs in Pharmacy Tiers

Brand-name drugs can be included in any tier, depending on your plan’s formulary. However, brand-name drugs are usually in higher tiers and have higher costs than generic drugs. The placement of a brand-name drug in a tier can vary depending on several factors, including the drug’s cost and availability of generic alternatives.

While brand-name drugs can offer benefits over generic drugs, such as more precise dosing or fewer side effects, they are often significantly more expensive. If a brand-name drug is in a higher tier, you may be responsible for paying a larger portion of the cost.

It’s important to review your plan’s formulary to understand which brand-name drugs are included and in which tier. If a brand-name drug is in a higher tier, talk to your doctor about whether there are generic alternatives available that may be more affordable.

Additionally, some plans may offer programs or discounts for brand-name drugs. Ask your plan provider about any programs or services available that can help make brand-name drugs more affordable.

By understanding the availability of brand-name drugs in pharmacy tiers, you can make informed decisions about your healthcare and manage your prescription drug costs more effectively. It’s important to review your plan’s formulary, compare prices at different pharmacies, and talk to your doctor about cost-effective options. This can help you find the most affordable and effective treatment options for your healthcare needs.

How to Get Brand-Name Drugs in Lower Tiers

If your doctor believes that a brand-name drug is medically necessary for your treatment, you may be able to request a coverage determination from your plan. A coverage determination is a formal request to your plan to cover a drug that is not included in your plan’s formulary or is in a higher tier.

Your plan may review your request and consider covering the drug at a lower cost or even moving it to a lower tier based on medical necessity. To request a coverage determination, you’ll need to provide your plan with supporting documentation, such as a letter from your doctor explaining why the brand-name drug is medically necessary.

It’s important to note that not all coverage determinations are approved. Your plan may deny your request, or it may only partially cover the cost of the drug. If your request is denied, you may have the right to file an appeal.

It’s also important to consider the cost of the brand-name drug and whether there are more affordable alternatives available. Even with a coverage determination, a brand-name drug may still be significantly more expensive than a generic drug.

By working with your doctor and plan provider, you can make informed decisions about your healthcare and manage your prescription drug costs more effectively. If you believe a brand-name drug is medically necessary, consider requesting a coverage determination from your plan. Additionally, review your plan’s formulary, compare prices at different pharmacies, and talk to your doctor about cost-effective options. This can help you find the most affordable and effective treatment options for your healthcare needs.

V. Brand-Name Drugs and Pharmacy Tiers

B. How to Get Brand-Name Drugs in Lower Tiers

If your doctor believes that a brand-name drug is medically necessary for your treatment, there are options to potentially get the drug covered at a lower cost. One option is to request a coverage determination from your plan. This is a formal request for your plan to cover a drug that is not included in your plan’s formulary or is in a higher tier.

To request a coverage determination, you’ll need to provide your plan with supporting documentation, such as a letter from your doctor explaining why the brand-name drug is medically necessary. Your plan may review your request and consider covering the drug at a lower cost or even moving it to a lower tier based on medical necessity.

It’s important to note that not all coverage determinations are approved. Your plan may deny your request, or it may only partially cover the cost of the drug. If your request is denied, you may have the right to file an appeal.

Another option is to apply for a patient assistance program (PAP) offered by the drug manufacturer. Many pharmaceutical companies offer PAPs that provide free or reduced-cost medications to individuals who meet certain income or eligibility requirements.

It’s also important to consider the cost of the brand-name drug and whether there are more affordable alternatives available. Even with a coverage determination or patient assistance program, a brand-name drug may still be significantly more expensive than a generic drug.

By working with your doctor and plan provider, you can explore your options for getting brand-name drugs at a lower cost. If you believe a brand-name drug is medically necessary, consider requesting a coverage determination or applying for a patient assistance program. Additionally, review your plan’s formulary, compare prices at different pharmacies, and talk to your doctor about cost-effective options. This can help you find the most affordable and effective treatment options for your healthcare needs.

Alternatives to Brand-Name Drugs

If the cost of a brand-name drug is too high, there may be alternatives available that are less expensive. Your doctor can help you explore alternative treatment options, such as using a generic drug or a different brand-name drug in the same class.

Generic drugs are identical to brand-name drugs in terms of their active ingredients, dosage, and effectiveness. However, they are often much less expensive. If a generic drug is available for your condition, your doctor may suggest that you use it instead of a brand-name drug.

Another alternative is to use a different brand-name drug in the same class. For example, if you’re taking a brand-name drug for high blood pressure, there may be other brand-name drugs available that are equally effective but less expensive.

It’s important to note that alternative drugs may have different side effects or may not be as effective for your specific condition. It’s important to discuss your options with your doctor and make an informed decision based on your individual healthcare needs.

As you navigate your Part D prescription drug plan, it’s essential to keep in mind the different pharmacy tiers and how they can affect your prescription drug costs. By understanding how drug tiers work and using the strategies outlined in this guide, you can make informed decisions about your healthcare and save money on your prescription drug costs. Talk to your doctor, review your plan’s formulary, compare prices at different pharmacies, and explore alternative treatment options to find the most affordable and effective treatment for your healthcare needs.